Learn Center

Can I Open a Savings Account for My Child?

EXPECTED READ TIME:6 minutes

How many times have you wished you knew then what you know now — especially when it comes to money management? As a parent, one of the most valuable life lessons you can share with your kids is the importance of saving money.

And one of the best ways to make the learning experience more hands-on and enjoyable is to open a savings account for your child.

Here are some tips and points to ponder when you’re ready to start showing your kid the art and science of managing money.

Is It a Good Idea to Open a Savings Account for Your Child?

Opening a savings account for your child isn’t just a good idea — it’s a great idea. Using a savings account to teach kids about money will bring your lessons to life and help them develop a skill they’ll carry with them long after they leave the nest

Pros and Cons of Opening a Savings Account for Your Child

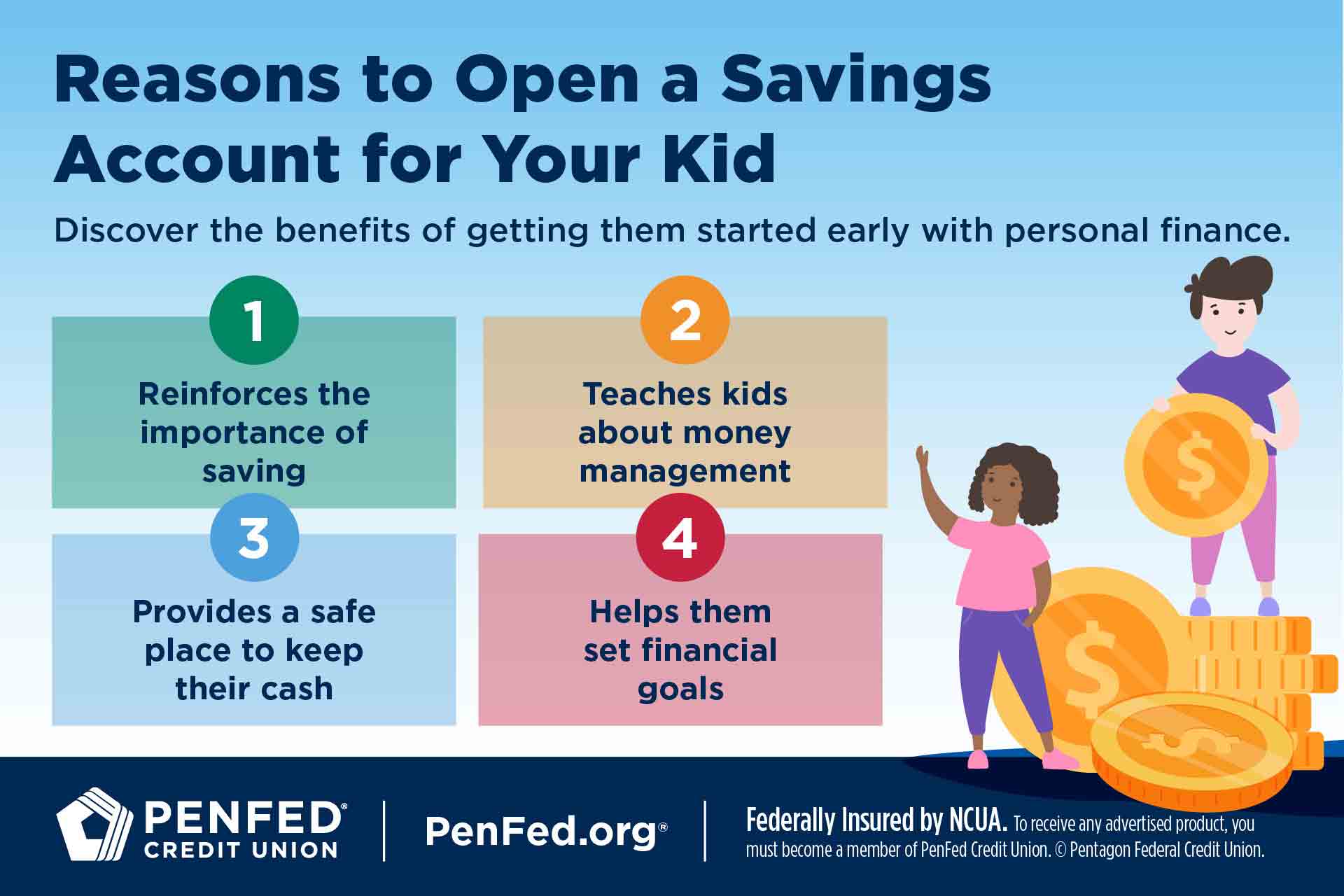

When you open a savings account for your child, you’re starting them on a financial journey that you can travel together. Showing your kid how to deposit cash and checks, view their balance online, and understand what they can and can’t do with a savings account will:

- Help them develop basic money management skills

- Highlight the importance of saving for the future

- Provide a safe place to put money where it can grow

- Allow them to set financial goals and work toward them

The biggest (if not only) drawback to opening a savings account for your kids is the age restriction. Most credit unions or banks require account holders to be at least 18 years old, so you’ll need to open a joint savings account while your child is a minor.

You’ll need to open a joint savings account while your child is a minor.

A joint savings account lists your name as well as your dependent’s name on the account and gives you each equal control over the money held there. When your kid turns 18 or reaches the age when your credit union or bank will allow them to be the sole owner, you can remove your name from the account.

| Pros | Cons |

|---|---|

| Helps teach money management skills | Must be 18 to open an account |

| Safe place to keep money and let it grow | Might limit number of monthly withdrawals |

| Can set up and manage in person or online | Annual percentage yield (APY) is generally low |

Allows you and your child to access and have equal control over the account |

Potential fees for maintenance, low balance, and too many withdrawals |

Alternatives to Joint Accounts

Although opening a joint account is an easy way to get your child started on the path to saving, there are other options. Two popular alternatives include:

- Savings accounts for kids. Many credit unions and banks offer accounts designed specifically for minors. These products, which are owned jointly by you and your child, often have a slightly higher APY and fewer fees than standard savings accounts that you might share with a child.

- Custodial accounts. A custodial account is a vehicle for saving that you set up and manage on your child’s behalf until they’re no longer considered a minor. Uniform Gifts to Minors Act (UGMA) accounts can accept cash, securities, annuities, and insurance policies as deposits, while Uniform Transfers to Minors Act (UTMA) accounts can hold any type of asset, including real estate, artwork, royalties, and patents.

A custodial account is a vehicle for saving that you set up and manage on your child’s behalf until they’re no longer considered a minor.

How to Open a Savings Account for Your Child

The traditional — and arguably most fun and more educational — way to open a joint savings account for your child is to take them to a branch of your credit union or bank, where you can meet with a financial advisor who’ll walk you through the application process. This hands-on approach usually includes:

- Providing personal information about you and your child

- Verifying your identity and your child’s date of birth

- Showing proof of residence with supporting documents

- Making an initial deposit with cash or a check

The traditional — and arguably most fun and more educational — way to open a joint savings account for your child is to take them to a branch

If in-person is the route you choose, it’s best to schedule an appointment in advance. This will help you avoid long lines and it will ensure the right banking professional will be at that location when you’re planning to arrive.

On the other hand, if you’re pressed for time or prefer the convenience of not leaving your home, most credit unions and banks allow you to open a savings account online. Simply go to their website, choose the savings account option from their product menu, and enter the required information as you’re prompted.

Since you won’t be able to deposit a check or cash to fund the new account, you’ll need to transfer some money from one of your existing accounts into your child’s new savings account. If the new account isn’t at the same credit union or bank that you use, you’ll have to provide your routing and account number for an existing account or use a debit or credit card to make the minimum opening deposit.

Regardless of where you open a savings account for your child and whether you do it online or in-person, the process should take less than 20 minutes to complete. Then you can use real-world examples to add deeper meaning to your money management lessons.

Opening a joint savings account for your child is essentially the same as opening an account for yourself.

What Do I Need to Open a Savings Account for My Child?

Opening a joint savings account for your child is essentially the same as opening an account for yourself. In fact, the main difference is that you’ll have to provide a bit more information since their name will also be on the account. Typically, you’ll need:

- Child’s name, Social Security number, and birth certificate

- Your picture ID (driver’s license, passport, military ID)

- Your Social Security number or card

- Your credit union or bank account numbers

- Proof of address (bank statement, utility bill, etc.)

- Initial deposit (cash, checks) as required by the credit union or bank

4 Tips for Opening a Savings Account for a Child

If you decide the time is right to open a savings account for your child, make sure you set them up for success. Here are four tips to make the experience more rewarding for everyone:

1. Stick With a Savings Account

Although checking and savings accounts are similar in many ways, savings is a better choice for your child’s first foray into money management. Checking is designed for cash you plan to tap into often, which your minor probably doesn’t need to do until they’re older and can spend responsibly.

2. Do Your Research

Start with your credit union or bank when looking for a savings account for your child, but be sure to research products at other financial institutions. The key is to find an account with the fewest fees, highest yield, and most features.

The key is to find an account with the fewest fees, highest yield, and most features.

3. Use the Account

It’s perfectly fine to open a savings account and not think much else about it, but the magic happens when your child starts using the account. Rather than cramming cash in a piggybank, have them deposit money they receive for birthdays and chores (or any other reason) into their savings account, where it’s safer and will even grow a little in the process.

4. Make It a Learning Experience

While it’s easier to open an account online, you can make the moment more teachable — and memorable — by taking your child to your credit union or bank to start their savings adventure in person. Spend time showing them around the branch and explain how to interact with tellers to make deposits and other transactions. At home, help your child access their account online to check their balance, review their statements, and understand how APY impacts their account.

The Takeaway

Once you start teaching your child about money, it’s a good time to think about opening a savings account for them. The lessons they’ll learn and financial independence they’ll start to gain will last a lifetime.

Explore Savings Account Offerings at PenFed

Discover the diverse offering of products, services, and support available to our members.