CHECKING / SAVINGS

Why Is It Called a Share Account?

What you'll learn: The differences between share and savings accounts

EXPECTED READ TIME: 4 MINUTES

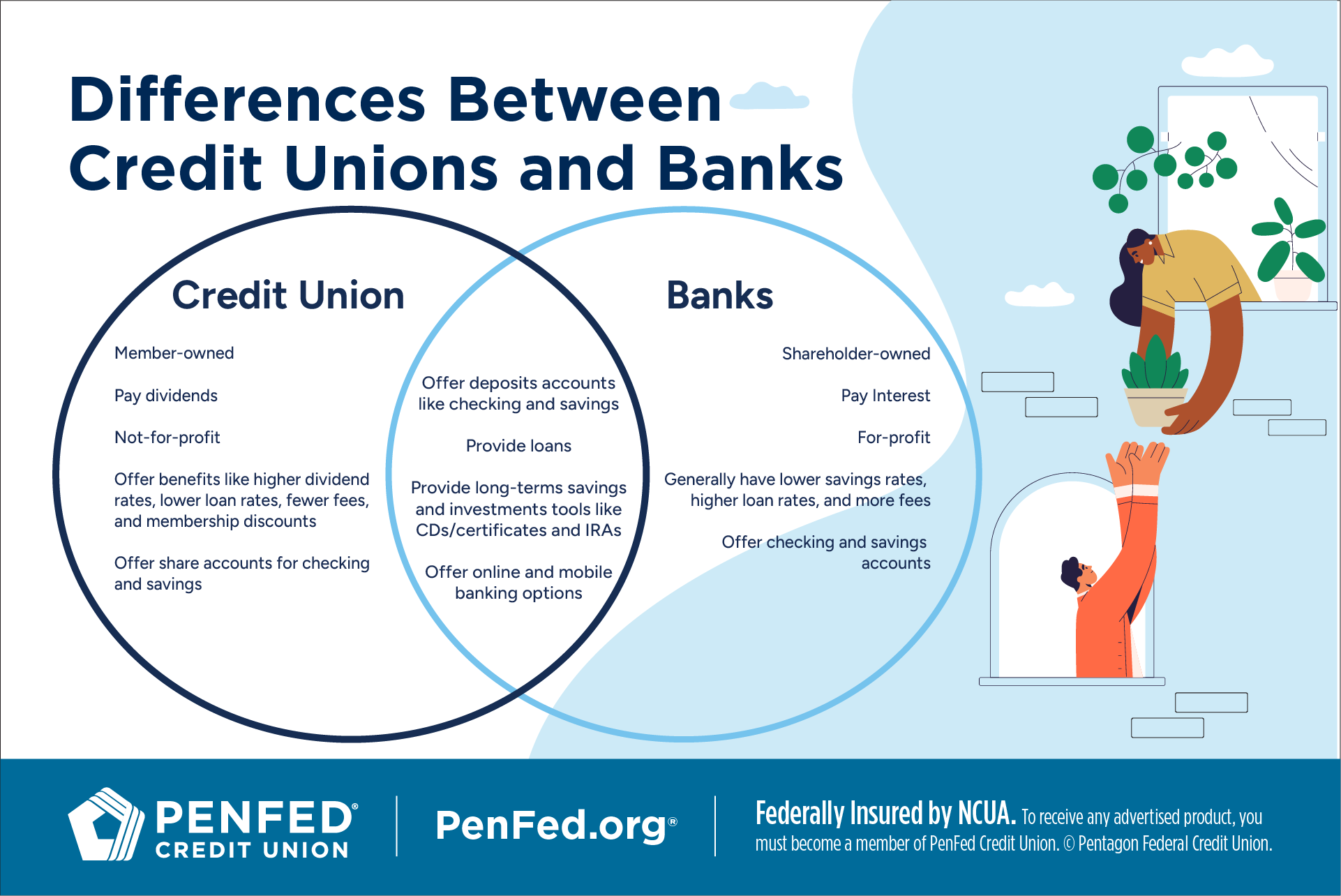

While credit unions and banks perform many of the same financial functions, terminology surrounding the two can be quite different.

For example, credit unions serve the needs of their members, while banks refer to their account holders — or simply their customers. Credit unions also use different names for the accounts they offer. For example, credit union members have share accounts while bank customers have checking and savings accounts.

If you’ve ever wondered what a credit union share account is and why each institution describes such similar services so differently, we’re here to unravel the mystery and explain why it matters.

Your savings account represents your share of the credit union — thus, it’s called a “share account” (or sometimes a share savings account).

Bank Shareholders vs. Credit Union Shareholders (Members)

Banks are run by outside shareholders (also called stockholders) who invest large amounts of money in the bank. While shareholders may make decisions that benefit bank customers, their main goal is for the bank to make money. After all, when the bank makes money, the shareholders split those profits.

In contrast, credit union members occupy both roles — the customer and the shareholder. This means they maintain personal accounts with the credit union and they also have the right to vote on decisions that shape the institution. They can elect members of the volunteer board of directors who make day-to-day decisions, and when the credit union turns a profit, that money is returned to the credit union’s members.

Interest vs. Dividends

Instead of interest, a credit union share account (where you keep your savings) earns you dividends. So, the same way a share account reflects your ownership in your credit union, the word “dividend” reflects that you’ve earned a portion of the credit union’s profits.

As cooperatives, credit unions seek ways to make life better for their members.

Instead of interest, a credit union share account (where you keep your savings) earns you dividends.

FAQs

Credit unions are not-for-profit financial institutions. They offer the same services as banks, including storing money in checking and savings accounts, providing loans, and cashing checks. As with banks, the money in credit unions is federally insured.

The main difference between credit unions and banks is that credit unions are owned by their members, while banks are for-profit institutions owned by shareholders.

Some people prefer credit unions over banks because of their unique benefits. Credit unions usually offer higher dividend (interest) rates on accounts, lower fees on loans, and special discounts and benefits for their members. The profit banks earn goes to their shareholders, while any profits credit unions earn are returned to members in the form of higher dividend rates, lower fees, or discounts.

The biggest differences between credit unions and banks are:

- Credit unions are not-for-profit institutions, while banks are profit-driven

- Credit unions are owned by their members, while banks are owned by private shareholders

- Credit union members can vote and have a say in how the institution runs, while bank customers cannot

Your money is equally safe in a credit union or bank. Deposits accounts (such as checking, savings, and certificates) are federally insured up to $250,000 per account holder at both credit unions and banks. Credit unions are insured by the National Credit Union Administration (NCUA) while banks are insured by the Federal Deposit Insurance Corporation (FDIC).

A share savings is a savings account at a credit union. You can deposit money in a share savings account and earn dividends on it just like you would earn interest on money in a savings account at a bank.

“Regular share account” and “primary share account” are alternate names for a share savings account. They’re basic savings accounts held at a credit union that are useful for emergencies, managing cash flow, or saving for specific goals.

Credit unions often refer to checking accounts as share draft accounts because you can draft — meaning to spend or withdraw money — from them. “Share” refers to the account owner’s stake in the credit union, and “draft” indicates that it’s a checking account rather than a savings account.

The Takeaway

Even though they serve you in just about the same way, the differences between credit union share accounts and bank savings accounts go far beyond branding. Credit unions use different language to remind you of the role you play in being a member, which is great because being a member of a credit union has a lot of benefits.

Learn More About Becoming a Credit Union Member

Discover the diverse offering of products, services, and support available to our members.