Checking/Savings

How to Choose Between a Credit Card and a Debit Card

What you'll learn: The differences between a debit card and credit card

EXPECTED READ TIME:4 MINUTES

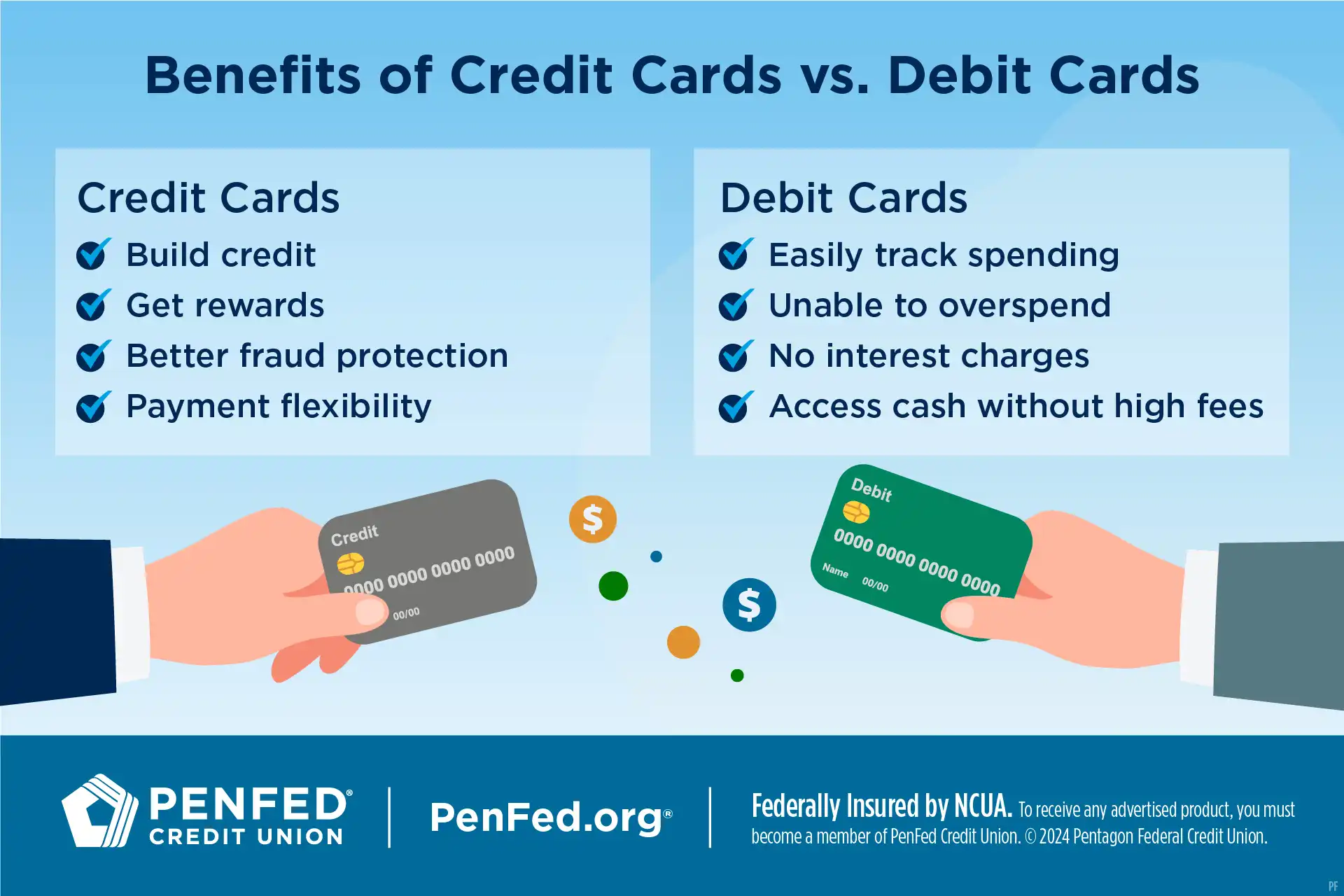

When you’re about to pay for a purchase, do you know how to choose between using a credit card and a debit card? It can be difficult to understand which is best in each situation, so in this article, we’ll tackle how credit cards and debit cards work and the advantages of each.

What We’ll Cover

How Does My Debit Card Work?

With some exceptions, you can use a debit card pretty much anywhere you use a credit card. The key difference is that when you use a debit card, you’re taking the money directly from your account rather than having a credit company pay for the item on your behalf.

Purchasing with a debit card is more straightforward: you can’t spend what you don’t have.

Advantages of Using a Debit Card

When you’re deciding whether to use a credit card or a debit card, there are some clear advantages to keep in mind when it comes to a debit card.

You Can Keep Track of Spending

There is no bill that comes due at the end of the month with a debit card. The money comes out of your account at the time of purchase, so it’s easy to keep track of your debit balance in real-time. That means no surprises about how much you’ve spent.

You Have Limited Potential to Overspend

The tendency with a credit card may be to buy now and think about it later. Purchasing with a debit card is more straightforward: you can’t spend what you don’t have. You can even set up your debit card — in many cases — to avoid overdraft fees, so your card will be declined if the funds are not available.

You Avoid Paying Interest

Not carrying a balance means you never pay interest on a balance. Using a debit card can save you from falling into credit card debt. Credit card debt can easily snowball if you’re not careful.

Cash is only a quick trip to the ATM away when you have a debit card.

Access Your Cash Faster

Cash is only a quick trip to the ATM away when you have a debit card. This is not the case with a credit card. For starters, not every credit card offers a cash advance and the ones that do often charge expensive fees. Overall, credit cards typically have more fees to avoid.

How Does My Credit Card Work?

You may have a credit card, but do you know how the process of using one actually works?

Let’s say you go to the coffee shop, buy a vanilla latte, and swipe your credit card to pay for it. Here, your card functions like a loan. The credit card company pays the local coffee shop the cost of the latte on your behalf with the understanding that you will pay the credit card company back for your latte at a later date.

Advantages of Using a Credit Card

Other than not having to carry cash, what good does a credit card do?

You Build Credit

Using a credit card responsibly can help you build your credit score. Your history of on-time payments shows you can be fiscally responsible. Lenders are more likely to want to lend money if they think you’ll pay it back on time.

Using a credit card responsibly can help you build your credit score.

You Get Perks

Credit card providers offer rewards cards that shell out alluring benefits. With credit cards, you can take advantage of perks like travel rewards, cash back, and points you can put toward future purchases of almost anything.

You Get Protection

While both credit and debit cards offer certain fraud protections, if criminals steal your credit card, they’re spending the money of the credit card provider — not you. When you dispute a fraudulent credit card charge, the amount is removed from your bill while the dispute is investigated.

With a debit card, the money immediately leaves your account and is returned after the investigation is completed. A credit card can be especially helpful if you’re traveling outside of the country and something goes wrong.

A credit card can be especially helpful if you’re traveling outside of the country.

You Have Flexibility in Paying

A credit card gives you more flexibility when deciding what to pay. With each monthly statement, you can choose to pay the minimum payment or, if you’re looking to avoid interest charges, up to the full balance each month.

Maybe, that flexibility does not mean much if you’re paying for a four-dollar latte. But if you have to buy something like a new refrigerator, it allows you to spread your payments out over time.

The right decision is the one that gives you the most peace of mind and the greatest control over your finances.

The Takeaway

If you’re trying to choose between using a credit card and a debit card, the right choice likely depends on your set of circumstances. A debit card can be a smart option for anyone just learning how to manage their finances. It can also be a safer bet for anyone trying to learn discipline when it comes to not overspending.

As a personal finance tool, a credit card offers more advantages than a debit card. Those advantages also come with added risk. If it’s not the right time, or if a credit card is not the right tool for you, that’s okay. The right decision is the one that gives you the most peace of mind and the greatest control over your finances.

Make the Most of Your Checking Account With a Credit Card!

Open an Access America Checking account and get 2% back on purchases made with a PenFed Power Cash Rewards Visa Signature® card.