CREDIT CARDS

Are Credit Union Cards Better Than Ones From Banks?

EXPECTED READ TIME:4 MINUTES

You don’t need to head to the bank to open a credit card. You can also go to a credit union and open one. Since these financial institutions are non-profit and member-owned, you may even get better rates and benefits than you would with a traditional bank.

Let’s dig deeper into what benefits you may receive by opening a credit union card and whether it’s the right move for you.

What’s the Difference Between Credit Cards From Credit Unions vs. Banks?

Both bank and credit union card services require their customers or members to fill out an application, even if they already have an account with that institution. Whether you get approved depends on factors such as your credit score. Both types of financial institutions offer different types of cards such as rewards credit cards, secured cards, and balance transfer cards. Some may charge an annual fee for cardholders, whereas others won’t.

The main difference is, credit union cards are from, you guessed it, a credit union, whereas other credit cards are issued by banks. Banks are for-profit and stockholder based. Credit unions are owned by their members.

Credit unions cards are from, you guessed it, a credit union, whereas other credit cards are issued by banks.

Both types of financial institutions have similar rules for credit card users. For example, you need to:

- Make minimum payments after each statement period

- Agree to pay any fees and interest charges

- Not exceed your credit limit

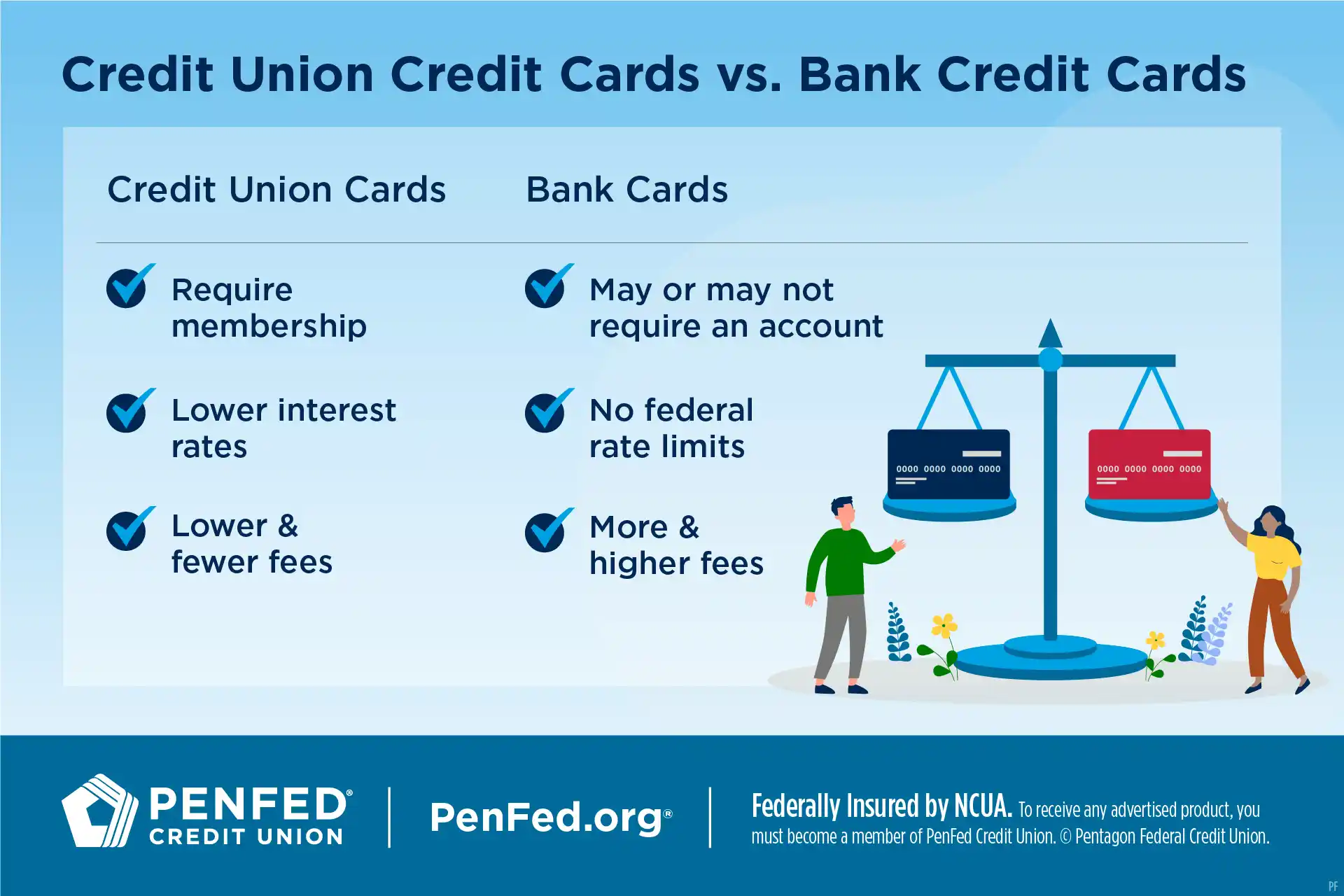

Credit unions usually require you to be a member of the credit union before you can open a credit card. Most banks won’t require you to open a bank account with them in order to open a credit card.

Credit unions usually require you to be a member of the credit union before you can open a credit card

What Are Some of the Benefits of Getting Credit Cards With Credit Unions?

Lower Interest Rates

Most credit union cards tend to have lower annual percentage rates (APRs) compared to cards issued by major banks. Banks don’t have these limits. That means if you intend on carrying a balance on your credit cards, you could pay less in interest for a credit union card depending on your card’s APR.

Lower Fees

Since credit unions are nonprofits, their profits are turned in to lower rates and fees and higher earnings for members. In other words, credit unions generally charge both lower and fewer credit card fees than banks. Credit unions tend to charge fewer annual fees, compared to similar credit cards from banks.

Better Customer Service

Banks usually have tens of millions of customers. Credit unions tend to have a smaller pool of members, which translates to shorter waits and better service for credit union members.

Credit unions tend to have a smaller pool of members, which translates to shorter waits and better service.

The Takeaway

Credit cards issued by banks may seem more familiar, but credit unions generally offer more competitive rates, fees, and membership benefits.

See Your Credit Card Options

Get a closer look at the credit cards we offer and their perks, benefits, fees, and rates.