AUTO

The Comprehensive Guide to Buying a Used Car

What you'll learn: Everything about buying used cars, from budgeting best practices to avoiding scams.

EXPECTED READ TIME: 16 MINUTES

You’ve reached the point where your car is asking for more than it’s giving. Maybe it’s the constant trips to the mechanic, costing you hundreds of dollars, or the recent breakdown that left you stranded by the roadside. Or maybe, your family has grown and you need more space (say, an SUV).

Maybe your teen is ready for their first set of wheels, or you can’t shake the idea of a second car — something sporty.

Whatever the reason, buying a used car can be a smart move for your wallet.

From hammering out a budget that makes room for desired features to understanding dealer fees, there’s a lot to consider before sealing the deal. Proper preparation allows you to drive away with not just a great car, but peace of mind.

We’ll walk you through the basics of how to buy a used car.

How Much Does a Used Car Cost?

Cost takes the driver’s seat in the new versus used debate.

Buying a used car can save you thousands of dollars, freeing up your budget for other priorities. The trick is knowing the market so you can get in when prices drop and avoid overpaying when they peak.

As of February 2025, the average price of a used car is $26,134. While the used car market has become less volatile than in recent years past, the cost of a car is still relatively high because of elevated interest rates.

Supply and demand also play a role. The COVID-19 pandemic forced automakers to cut the production of about 8 million vehicles. This means a substantial number of cars were (and are) not available for resale.

Supply and demand issues aside, lots of other variables impact the cost of used automobiles:

Year, make, and model: A newer, popular model will generally cost you more.

Size: An SUV with a powerful engine sounds great, but could push you beyond your budget.

Mileage: Lower mileage typically means a higher price tag.

Condition: A well-maintained vehicle commands a premium.

Features and accessories: Luxury features or upgrades can drive up the price.

Color: Certain colors may be more desirable, affecting resale value.

Location: Used car prices vary across regions.

There are numerous resources to help you determine if a particular used car is right for you. Here are a few:

Kelley Blue Book (KBB) is the gold standard for gathering pricing data and estimating the value of used vehicles.

Edmunds offers detailed pricing, ratings, and value information for used automobiles.

TrueCar allows you to research how much others in your area paid for their vehicles.

Ways to Pay for a Used Vehicle

You have two options when buying a used vehicle: pay cash or take out an auto loan. Cash offers a couple of advantages — no interest, no monthly payments, and instant ownership. But most people opt to finance. Whether it's through a dealership, trusted credit union, local bank, or online lender, financing is all about finding the right fit for your budget.

However, financing a used vehicle can be a bit trickier than finding the best loan option for a new one. That's because lenders see a used vehicle as a higher risk, making it less attractive as collateral for the loan. If you were to default, the lender would be left with an asset that’s already depreciated.

Interest rates are also higher for used cars, but don’t let that scare you. Rates vary based on a variety of factors, including your credit score, the car’s age and mileage, and even the lender you choose.

You can get a general idea of the APR you'll qualify for based on your credit score category. This is just a starting point. Talk to your local credit union or bank for personalized offers and advice.

| Credit Score Category (as of Q4 2024) |

|---|

| 300 to 500 (Deep Subprime) |

| 501 to 600 (Subprime) |

| 601 to 660 (Near prime) |

| 661 to 780 (Prime) |

| 781 to 850 (Super Prime) |

Safety, reliability, and affordability are non-negotiable, and going through a trusted car-buying service can save you from a bad deal.

Best Times to Buy a Used Vehicle

Thinking of getting a used car from a private party? It’s first-come, first-served. If you spot a car you love at the right price, go for it.

Dealerships, however, play by a different set of rules. Timing your visit can make a difference for your wallet. Here’s when you might find the best deals:

Beginning of the calendar year: Dealers often receive a wave of trade-ins from December’s new car sales, making the first quarter a prime time for used car deals.

Latter part of each month or quarter: Dealerships push hard-to-meet sales goals at the end of each month and quarter, motivating managers to drop prices so they can close more deals.

Weekdays: Dealerships tend to be slower on weekdays, especially mid-week. This can give you more time to ask questions and negotiate. A little research beforehand can even make a lunch hour visit productive.

Around certain holidays: Major new car sales events happen around holidays like Martin Luther King Jr. Day, Presidents’ Day, Black Friday, and Christmas Eve. The day after is usually a great time to find a used car. A 2023-2024 iSeeCars study found that New Year’s Eve and Day are the best holidays to shop for used vehicles, with nearly 48% more deals than average.

When new models arrive: Dealerships tend to discount older pre-owned inventory when newer models roll in.

Best Used Cars to Buy

Ask 10 people about the best or worst used car to buy, and you’ll get a whirlwind of opinions. Your best friend loves their spacious SUV, your neighbor is all about their fuel-efficient hybrid, and your teen wants an advanced sound system.

Personal experiences, preferences, and budgets vary widely — what works for one person might be an inconvenience for another. However, safety, reliability, and affordability are non-negotiable, and going through a trusted car-buying service can save you from a bad deal.

Safety

Safety should be at the top of your list when shopping for a used car. Look for models with excellent safety ratings and these essential features:

Three-point seat belts: These are your first line of defense in a crash, providing restraint across the lap and shoulder.

Airbags: Side impact and curtain airbags provide a protective cushion in a crash, reducing the risk of head and upper body injuries.

Electronic stability control: This feature prevents skidding, helping you maintain control when driving on wet or icy roads.

Anti-lock braking system: This system prevents wheel lockup, helping you steer around obstacles during a hard stop.

Automatic emergency braking: This feature reduces the chance and severity of collisions by automatically applying the brakes.

Backup cameras: These make reversing safer and easier by giving you a clear view of what’s behind you.

Blind spot detection: This feature helps you avoid collisions by alerting you about vehicles in hard-to-see spots.

Reliability

The shiniest of cars will quickly lose its luster if it's always in the repair shop — and your wallet will feel the pinch. Do your research using resources like the Insurance Institute for Highway Safety (IIHS), National Highway Traffic Safety Administration (NHTSA), and popular car forums. Then, choose a make and model known for its reliability. It’s an investment in worry-free driving.

Get a Pre-Purchase Car Inspection

This step is crucial, even if the car you’re going for looks perfect. Get a trusted mechanic to check everything from the engine and transmission to the brakes and suspension. They’ll look for leaks, listen for strange noises, and even pore through the interior.

The goal is to gauge reliability, helping you avoid costly repairs down the road.

Vehicle Test Drive Tips

A test drive is your chance to really get to know the car you’re considering. It’s like a first date! When you have your hands on the wheel, is it easy to control? What about the gas and brakes? Are they responsive?

The seat should feel supportive, you should have a clear view through all windows and mirrors, and there should be no awkward vibrations. Play around with all the features. Make sure the radio, air conditioning, and other gadgets are working properly.

It’s important to strike a balance between practicality and the features that will make your drives enjoyable.

Affordability

Your dream car shouldn’t drain your bank account.

The 15% rule is one way to ensure that your buy fits your lifestyle and budget. This guideline suggests keeping your total monthly car expenses (including loan payments, insurance, maintenance, and fuel) at or below 15% of your gross monthly income.

For those who prefer a stricter, more elaborate approach, there’s the 20/4/10 rule. Put down 20% of the vehicle’s purchase price, finance for no more than four years, and keep insurance, maintenance, and fuel costs under 10% of your post-tax paycheck.

Sticking to a budget doesn’t mean sacrificing comfort or convenience. You’ll be spending a lot of time in your car, so it’s important to strike a balance between practicality and the features that will make your drives enjoyable. Maybe it’s the heated seats for chilly mornings, ample cargo space for weekend adventures, or the panoramic sunroof that lets you soak in the springtime sunshine.

The moment you decide to get a used car, start building your sinking or emergency fund, factoring in things like potential repairs, winter tires, fuel costs, insurance, cosmetic upgrades, and protective gear and accessories for the interior. And make use of an auto loan calculator.

Worst Used Cars to Buy

If the best used cars are safe, reliable, and budget-friendly, then the worst (or least desirable) cars are the exact opposite. Avoid models that over-extend your finances, have low safety ratings, and are prone to frequent breakdowns and expensive repairs. Beyond these dealbreakers, there are other red flags to watch for as you shop, especially from private sellers.

1. It has a branded title

A used car’s title tells a story. If it has a branded title, it could mean there’s something wrong with the car’s history or condition, making it unsafe to drive. Branded titles are issued by a state’s Department of Motor Vehicles (DMV) and are usually printed or stamped on the title certificate. A copy of the car's Carfax or AutoCheck report will also contain this information, along with other important details like the vehicle identification number. Here’s a breakdown of some common branded titles:

Salvage title: If a car has this type of title, it means an insurance company declared it a total loss due to extensive damage caused by a crash, flood, fire, or something else. While the low price might be tempting, a vehicle with this title could cause safety issues later.

Reconstituted/reconstructed title: A car with this title was once salvaged. Despite repairs, it may have hidden safety and reliability issues.

Bonded title: If you see a bonded title, then there’s an unresolved issue with the car’s ownership. For example, the original title is missing. In such cases, the state requires a surety bond to guarantee ownership. Be aware that long, unexplained gaps in ownership history could mean the car was neglected for a period of time.

Lemon title: This title tells you the car has a history of recurring issues that couldn’t be fixed, even after multiple repair attempts. It might seem fine for now, but the problems could resurface.

Junk title: This is the end of the line for a car. It’s basically a declaration that the car is only good for certain parts or scrap.

Odometer rollback title: If you see a mileage that seems too good to be true, it might be. This title means someone reduced the mileage to make the car appear newer and more valuable.

Flood title: A car with this title indicates significant water damage, which can cause rust, mold, and other major problems in the engine, electrical system, and interior.

Title washing alert: Watch out for cars with clean titles and histories from other states, as this could be a sign of title washing. This is a scam where sellers move a branded-title vehicle to a state with less strict title laws, allowing them to mask its troubled past.

Watch out for cars with clean titles and histories from other states, as this could be a sign of title washing.

2. It’s missing service records

A car’s service history is like its medical record. If the seller can’t provide complete records or their story about the car’s history seems inconsistent, it could be a sign that the car hasn’t been properly maintained. Proceed with caution.

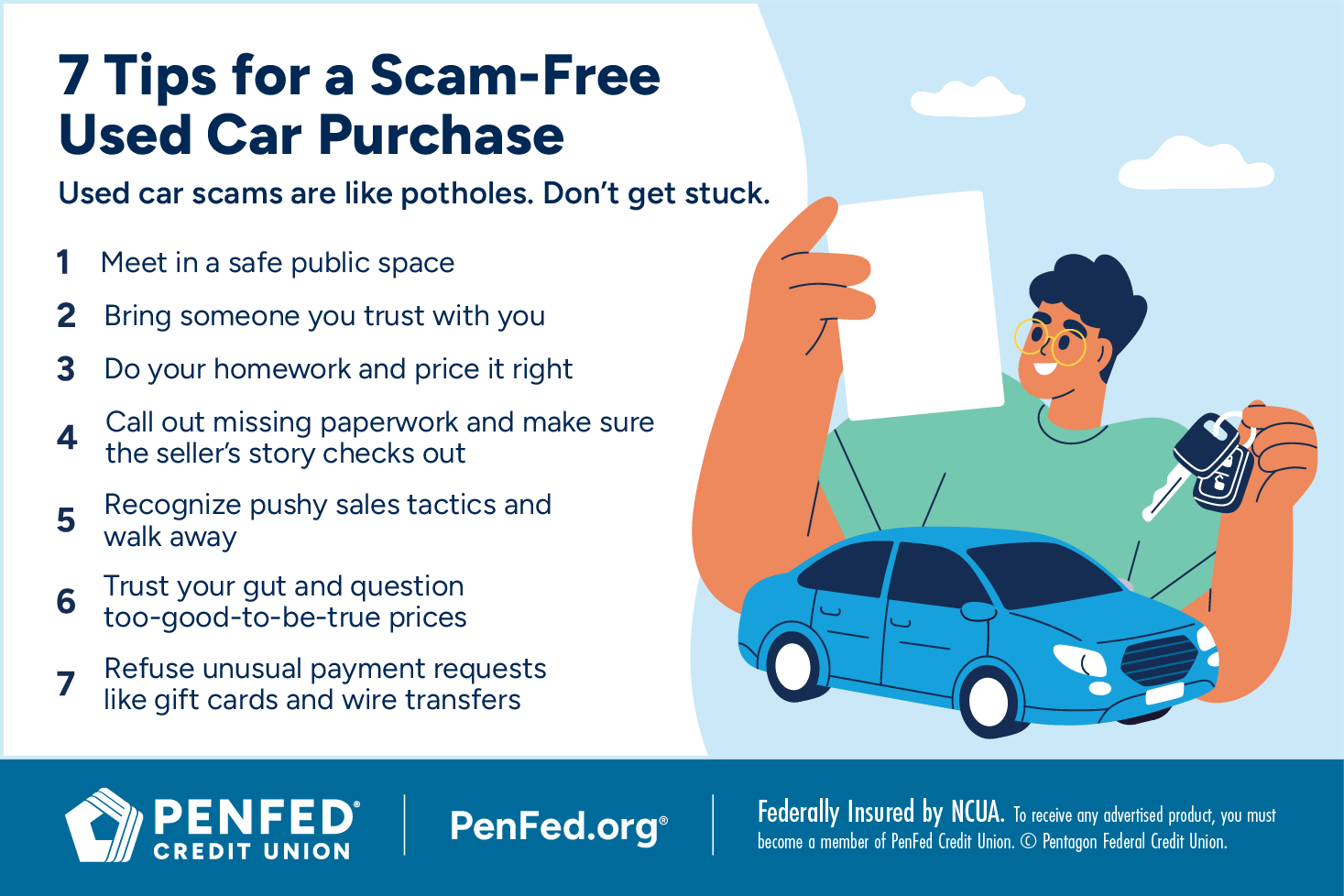

Avoid Scams

Buying from a private seller can save you some cash, but you have to be extra careful. Here’s how to play it safe:

Meet in public: Choose a safe, well-lit public place. If the seller refuses to meet in person or let you inspect the car thoroughly, then something is off.

Bring backup: Have a friend or family member tag along for a second (and third) opinion. Perhaps, they have more experience when it comes to what to look for when buying a used car.

Do your homework: Research the car’s value using an online valuation calculator.

Follow the paper trail: Make sure all the paperwork is in order.

Recognize pushy sales tactics: Don’t let anyone pressure you into a shady deal. Take your time and walk away if you must.

Question extremely low prices: If it seems way cheaper than it should be, it probably is and not for good reason.

Stick to secure payment methods: Gift cards or wire transfers are almost always bad news. Safe ways to pay include a cashier’s or certified check.

If the seller balks at a mechanic’s inspection, you should probably walk away.

Questions to Ask When Buying a Used Automobile

Many dealerships acquire pre-owned cars through trade-ins or auctions, making it difficult to access a complete and detailed history. That's why it's important to ask for a copy of the car's Carfax or AutoCheck report. They're not foolproof but can provide some degree of assurance.

Buying from a private seller allows for a more personal interaction, and you’ll get the information straight from the source. Just make sure you’re asking the right questions.

How was the vehicle maintained?

If possible, talk to any mechanics who routinely worked on the vehicle.

Has the vehicle been in any accidents?

Many, but not all, accidents will appear in the vehicle report, so make a point to ask about any fender benders or other damage. If the vehicle was in an accident, find out:

- How it was damaged and to what extent

- Which auto shop carried out the repairs and when

- If the work is guaranteed and has a transferrable warranty

What systems and features are malfunctioning?

While a burned-out light in the dashboard probably shouldn't be a dealbreaker, be cautious of weak air conditioning, missing pixels in displays, and other malfunctioning systems that could indicate serious and expensive underlying issues.

What's the ownership history?

Ideally, the seller will be the original owner who has a notebook or folder of receipts from service appointments, but that's rarely the case. Even if the vehicle has numerous owners, the person trying to sell it to you should be able to tell you something about where they got it. If not, that's a red flag.

Why are you selling the car?

Most sellers will have prepared an answer, but it's still worth asking. Pay attention to how they respond. Intuition will help you decide whether to trust the answer and seller.

Do you have a title in hand?

When you finalize a deal, the seller will transfer ownership by signing the vehicle's title over to you. If he or she doesn't have the title, it can complicate the process or terminate it altogether.

There are ways to complete the sale if the owner misplaced the title or doesn't have it because of an outstanding loan on the vehicle. It's up to you whether the car is worth the additional time and effort to secure the title.

Can I have a mechanic inspect the vehicle?

This should be a given when buying a vehicle that you know nothing about. If the seller balks, you should probably walk away.

How Much Mileage Is Too Much?

As the numbers on the odometer increase, so does the chance of your car needing a little maintenance, or a lot. So, how do you know if you’re looking at a reliable ride?

The truth is there’s no magic number. It depends on how long you plan to keep the car and how much you’re willing to spend on repairs.

While the cars in the US typically rack up around 10,000 miles a year and can last for 12 years or 200,000 miles with proper maintenance, that’s just an average. Some cars might be ready for retirement sooner, while others could keep going.

Keep in mind not all miles are created equal. Highway miles are easier on a car than stop-and-go city traffic. A car that’s mostly seen open roads will likely have less wear and tear than one that’s battled rush hour traffic. On the flip side, a car with low mileage and a spotty maintenance history might be in worse shape than its odometer suggests.

A comprehensive review of the vehicle’s history and condition and your personal needs can help you pinpoint your mileage sweet spot.

A car with low mileage and a spotty maintenance history might be in worse shape than its odometer suggests.

Should You Buy an Extended Warranty?

If you’re buying your used car through a dealership, they may offer you an extended warranty. This optional coverage, also known as a vehicle service contract, is designed to cover certain repairs after the original warranty expires.

But do you need it? Maybe.

Here are some scenarios in which an extended warranty makes sense:

Scenario 1: Cruise through repairs

You’ve just purchased a car with all the bells and whistles — a touchscreen infotainment system, backup cameras, and cruise control. But what happens when the technology malfunctions? An extended warranty could help with costly, unexpected repairs.

Scenario 2: Go for peace of mind

You’re looking at a car with a higher mileage. You’re excited about the savings and based on the smooth test drive and clean history, you’re confident you’ve found the one. Though it appears to be in good shape, you know that extensive use can take a toll on major components like the engine and transmission. At its core, an extended warranty is insurance. And, like insurance, the biggest benefit is the peace of mind that comes with knowing you're covered — at least to some degree — in the event of "what-ifs."

Scenario 3: Mix and match your coverage

You’ve found the perfect used car, but it has a few quirks. The air conditioning is a bit finicky and the sunroof sticks from time to time. You’re not too worried but wish you could find a warranty that makes sense for you. That’s where customization comes in. Many extended warranties allow you to pick and choose. Want extra protection for that temperamental AC or glitchy sunroof? Ask your provider.

Potential benefits aside, extended warranties aren't ideal for every car or individual. Weigh the advantages and disadvantages:

|

Pros |

Cons |

|---|---|

|

Helps reduce costs of some repairs |

Typically adds thousands to vehicle price |

|

Provides peace of mind |

Often goes unused |

|

Can customize to meet specific needs |

There may be limits on what is covered |

Used Vehicle Dealer Fees

Take a close look at most used car agreements and you’ll spot a list of fees that might give you pause.

Legitimate fees included in your out-the-door price are:

State and local sales taxes

Registration and title fees

A documentation fee to cover the cost of preparing and filing the sales contract and other paperwork

If any of these charges appear on your paperwork, ask the seller to remove them:

Reconditioning fee: This is how dealers get you to pay for the pre-sale preparation. Cleaning, detailing, mechanical repairs, and safety inspections are a standard part of dealership business — not your responsibility.

Additional destination fee: There might already be a destination fee on your bill, but some dealers add to it, claiming it’s for local delivery.

Cash upcharge: This is a fee that some dealers demand if you’re paying cash, which is hard to justify since cash payments are immediate and generally less complicated than financing.

Vehicle history report: Some dealers try to charge you for the car’s report even though it’s a standard component of the purchasing process.

How to Negotiate a Used Car

Car negotiation is an artform, whether you're buying new or used. It’s also nerve-wracking for a lot of people. These tips can steer you in the right direction:

1. Do your research

Doing research before test drives can help you find exactly what you want for the best price. Start by referencing Kelley Blue Book, Edmunds, and/or TrueCar to get a general idea of used cars and trucks in your area.

2. Know your numbers

Determine the fair market value (or range) for the vehicle you're considering. Knowing the "going rate" for a particular car or truck in your area allows you to justify your price when you begin wheeling and dealing. It can also help you to stay calm, build confidence, and ask the right questions on the lot.

3. Be patient — and don't be afraid to walk away

One of the worst things you can do is appear desperate to get a deal done. If you can't agree when negotiating or don't like the seller or salesperson’s vibe, it’s time to leave. A negotiation that doesn’t end in a deal is still good practice.

If you can't agree when negotiating or don't like the seller or salesperson’s vibe, it’s time to leave.

Insurance

You’ve haggled like a pro and now your dream car is yours. Don’t skimp on insurance — it’s how you protect your investment.

Before you hit the road, look for comprehensive coverage to protect your car from things like theft, vandalism, or a harsh hailstorm. You’ll also want to consider collision coverage, which protects your car if you’re in an accident, regardless of who’s at fault. Liability coverage is usually required by law, and will help pay for costs related to another driver’s injuries or damaged vehicle.

And if you’re financing, there’s guaranteed asset protection (GAP), which is designed to alleviate the stress of paying off your loan if your car is totaled. Of course, read the fine print and ask your provider questions to make sure it’s something you want.

The Takeaway

Sure, a brand-new car smells great and turns heads, but a used car can look and feel equally nice and is easier on your wallet. If you do your homework and stick to your budget, you’ll end up with a reliable ride — maybe even your dream car.

Ready to Find Your Perfect Ride?

Don’t let financing slow you down. PenFed makes it easy for members to get the car loan they need with competitive rates.