Checking/Savings

What Is a High-Yield Savings Account?

What You’ll Learn: Learn what a high-yield savings account is and how to use it most efficiently.

EXPECTED READ TIME: 8 MINUTES

A savings account is one of the most basic tools of personal finance. But when it comes to making money, its low interest rate can be a letdown.

If you need the flexibility and security of a savings account but want better earning potential, consider opening a high-yield savings account.

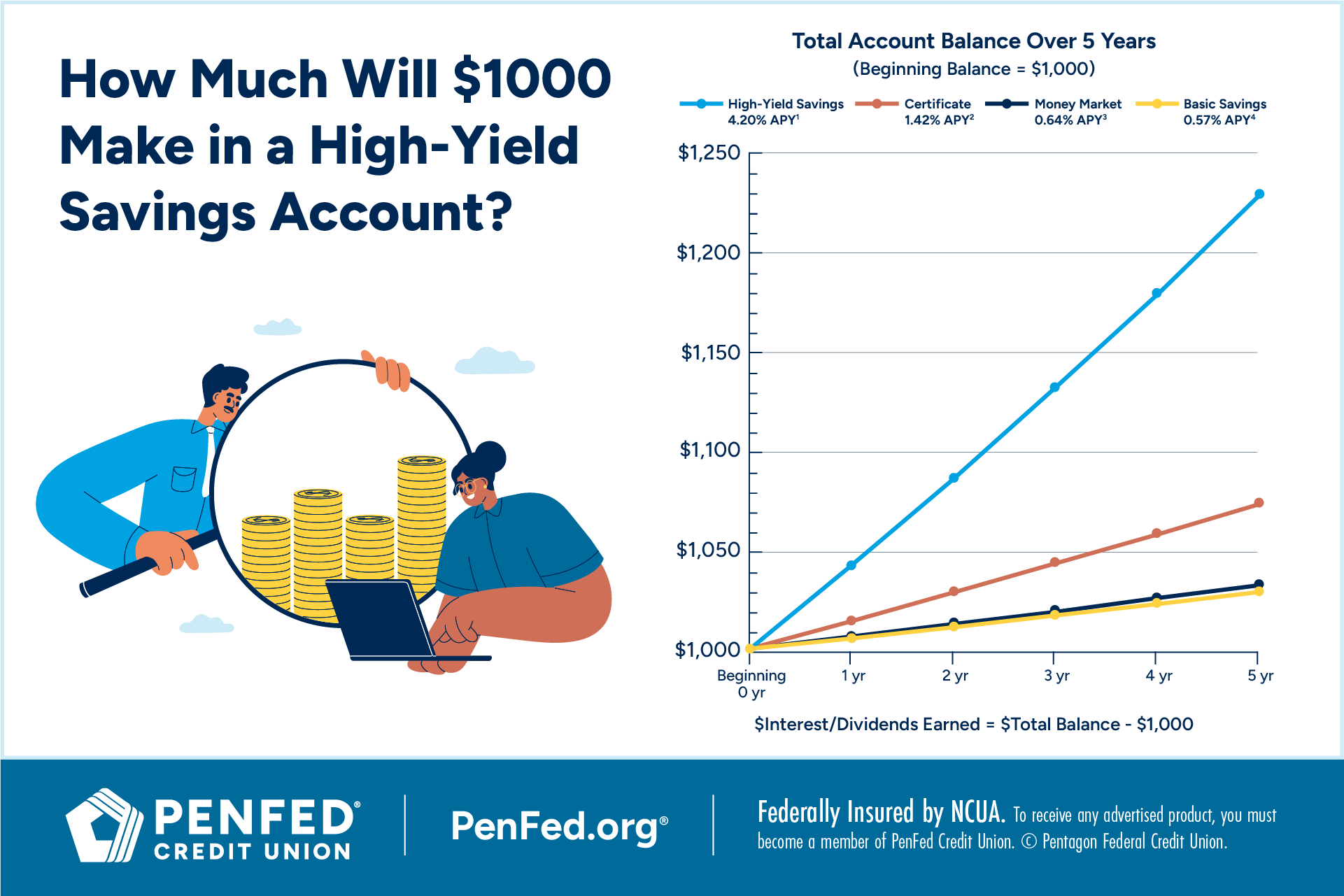

Graph data assumes a $1,000 initial deposit with no additional contributions. Rates are average national interest rates for each savings product as of November 2024, according to the following sources:

- 4.20% APY. Knueven, L., S. Acevedo, & S. Silbert. (2024). Average Savings Account Interest Rates: A Comprehensive Guide. Business Insider

- 1.42% APY. Bennett, K. & Wojno, M. (2024). Historical CD interest rates: 1984-2024. Bankrate.com.

- 0.64% APY. Bond, C. (2024). Money market account rates today, November 7, 2024: Secure up to 5.00% APY ahead of the next Fed rate cut. Yahoo! Finance.

- 0.57% APY. Cabello, M. & Kuchar, K. (2024). What is a high-yield savings account? Definition and what to consider. Bankrate.com.

What is a High-Yield Savings Account?

A high-yield savings account is essentially the same as a traditional savings account except that it offers a significantly higher APY. For comparison, the national average APY on basic savings accounts is 0.57% APY, while many high-yield accounts offer rates 20 times that at 4% or higher.

The APY, or annual percentage yield, on your savings account is important because it offers an estimate of how much your account will earn in one year, including compounded interest/dividends. An interest rate shows how much interest (or how many dividends) your account will earn, but doesn’t take into account how often it compounds. For that reason, APY gives a better sense of how much money you’ll actually earn.

How Does a High-Yield Savings Account Work?

High-yield and traditional savings accounts are similar in many ways. You can have a joint account with your partner or child where each person can access the money in it. You can also easily transfer money between your high-yield savings and other accounts.

Besides offering higher APYs, high-yield accounts differ from traditional accounts in a few other ways. For starters, they often have higher minimum balance requirements both to open and maintain the account. In some cases, they may also carry higher fees or cap the amount you can earn on your account.

Over time, this passive income can help fund trips, cover educational costs, or even augment your retirement.

Pros of High-Yield Savings Accounts

The main advantage of having a high-yield savings account is earning a higher APY on your savings. Over time, this passive income can help fund trips, cover educational costs, or even augment your retirement thanks to compound interest/dividends.

Both regular and high-yield savings accounts are highly liquid. Unlike certificates that lock your money in for a predetermined period, it’s easy to dip into high-yield accounts for unexpected expenses or to temporarily cover cash flow issues.

High-yield accounts are also safe. Unlike stocks and similar risky investments, you won’t lose money that’s in a savings account (although it may not keep pace with inflation). And just like traditional savings and checking accounts, high-yield accounts are FDIC-insured at banks and NCUA-insured at credit unions up to a total of $250,000 per institution.

It’s easy to dip into high-yield accounts for unexpected expenses or to temporarily cover cash flow issues.

Cons of High-Yield Savings Accounts

Most savings accounts set a monthly limit on the number of transfers and withdrawals you can make. If you exceed that number, you may be charged a fee or lose the higher APY on your account.

APYs are variable as well, so it’s possible to open an account with a competitive rate and experience a rate drop over time due to fluctuating economic factors. And even at their highest, high-yield accounts offer lower returns than more aggressive investments like ETFs, dividend stocks, and REITs.

High-yield accounts can set stricter standards, too. They may require a larger opening balance and minimum monthly balance to maintain your account. Along with transfer and withdrawal limits, this could make your high-yield savings marginally less liquid than a traditional savings account.

How to Choose a High-Yield Savings Account

You can open a high-yield savings account with almost any bank, online bank, or credit union, but not all accounts are created equal. Here are some features you should compare before selecting an account.

Minimum Deposit

Each financial institution sets its own minimum deposit for its high-yield savings accounts. If one institution is too expensive, another will be more affordable.

You can also open a basic savings account and save until you have enough to convert to a high-yield account. Just remember that you’ll need to be able to maintain your monthly minimum balance for whatever account you open. If you don’t, you could lose your earnings to fees.

If one institution is too expensive, another will be more affordable.

APY Over Interest Rate

Don’t get caught up in interest/dividend rates. You’ll make more money with a lower interest/dividend rate and higher compound frequency. That’s why it’s better to compare the APY on different accounts instead of the interest/dividend rate.

Fees

Just like with checking accounts, fees on high-yield accounts vary from one institution to another. Pull out your calculator, crunch some numbers, and compare. Earning a higher APY won’t help you if you’re paying exorbitant fees on your account.

Withdrawals and Transfers

One advantage to a savings account, high-yield or otherwise, is easy access to your savings. Compare any limits on the number of withdrawals and transfers and what penalties you’ll incur if you go over that limit. Do these restrictions work with how you plan to use your account?

Pull out your calculator, crunch some numbers, and compare.

Institution

Finally, take a look at the institution you’ll be opening your high-yield savings account with. Do you already have accounts with this institution? If not, how easy will it be to transfer or withdraw funds from your account?

There may come a day when you need help with your account. Does the bank or credit union you’re considering have good reviews? Are their current customers happy and able to find support when needed?

Think about the way you use your current bank accounts and the features you need. Are you looking for robust security? A slick mobile app? ATM access?

Finally, is the institution insured by the FDIC (for banks) or NCUA (for credit unions)? If not, your money will be vulnerable.

Tips for Maximizing Your High-Yield Savings Account

While there isn’t a right way to use your high-yield savings account, there are strategies that can help you grow your savings more efficiently. Here are a few to get you started:

Determine Your Account’s Purpose

There’s no limit to the number of savings accounts you can have, and many people benefit from having more than one as long as they have a clear purpose for each account. High-yield accounts are flexible and utilitarian. They’re great for:

- Emergency funds

- Short-term savings goals like vacations or big purchases

- Bigger savings goals such as opening a certificate or money market account

- Sinking funds for irregular expenses like annual subscriptions, car maintenance, or vet bills,

Automate Your Savings

Use direct deposit to automatically deposit part of your paycheck into savings. You can also set up automatic transfers from checking to savings.

Make Saving Part of Your Budget

Budgeting isn’t just about spending. Create a realistic plan for how much you want to save each pay period rather than saving from what’s leftover.

Set and Track Savings Goals

Writing down your savings goal can be highly motivating. Create a chart or graph and track your progress to stay engaged with your goal.

Don’t Withdraw Your Money

Once your savings look healthy, it can be tempting to reduce the amount you save or start spending from savings. Automating your savings and tracking your goals can curb this temptation, as can setting aside a little “fun money” for going to the movies, a night out with friends, or that great outfit you’ve been wanting.

Use direct deposit to automatically deposit part of your paycheck into savings.

How High-Yield Savings Accounts Compare to Other Savings Options

A high-yield savings account is a great way to start saving, but it’s only one of many products that can help you grow your money. Here’s how high-yield accounts compare against your other options:

|

|

Cost to Open |

Yield Potential |

Risk |

Liquidity |

Knowledge and Management Required |

|---|---|---|---|---|---|

|

High-Yield Savings |

$0-$100 |

Low and slow Grows on dividends and compound interest |

None |

Liquid but subject to limited withdrawals and transfers |

Little |

|

Certificates |

$500-$1,000 |

Low and slow Grows on compound interest |

None Insured by FDIC or NCUA |

Illiquid, subject to early withdrawal penalties |

Little |

|

Money Market Savings |

Hundreds to thousands |

Low and slow Grows on dividends and compound interest |

Low, but earnings can be vulnerable to high fees Insured by FDIC or NCUA |

Liquid but subject to limited withdrawals and transfers |

Moderate |

|

Retirement Accounts |

Varies by account type and institution |

Medium and slow Grows on dividends, stock splits, stock sales |

Low Not insured |

Illiquid, subject to early withdrawal penalties |

Moderate to high |

|

Stocks, ETFs, Index Funds |

Varies from investment to investment |

Low to high Grows on dividends, stock splits, stock sales |

Medium to high Not insured |

Liquid |

High |

Alternatives to High-Yield Savings Accounts

A high-yield savings account is a great tool to have in your financial toolbelt because of its earning potential and versatility. But when it comes to saving, it’s far from your only option. Here’s how high-yield accounts stack up against other tools.

Certificates

Certificates often offer slightly better rates than high-yield accounts, especially those with longer terms. The downside is your money could be locked into that account anywhere from 6 months to 7 years. If you need your money before then, your withdrawal will be subject to penalties.

Your interest rate is locked in for the duration of your certificate as well. On the one hand, rates for high-yield accounts could drop if the Federal Reserve lowers interest rates, while your certificate will keep its rate regardless. On the other hand, you won’t be able to take advantage of higher rates until your certificate matures.

Certificates often require a higher minimum opening deposit than what’s required to open a high-yield account. While it varies by institution, $500-1,000 is a common baseline, while you can open some high-yield savings accounts with $0. Of course, the accounts with the highest APYs require higher opening balances.

Money Market Accounts

Money market accounts offer interest rates that often rival those of high-yield savings and certificate accounts. Because they come with debit cards, they’re slightly more flexible than high-yield accounts (although they usually have a monthly transaction limit).

However, money market accounts usually come with higher minimum balance requirements and higher fees. These fees can easily eat into your earnings if you’re not careful. Their interest rates are also variable, so you could start with a great rate that declines in time.

Money market accounts are safe and low risk, though. They’re FDIC- or NCUA-insured, just like checking and savings accounts.

Money market accounts usually come with higher minimum balance requirements and higher fees.

Retirement Accounts

Retirement accounts are a great option for saving money because your contributions are taxed differently than regular savings. Employer-backed accounts such as 401(k)s and 403(b)s are your best bet because of the additional contribution from your employer. But independent tools like IRAs can be effective as well.

The trick to making retirement accounts work for you is to contribute steadily over time. Money in these accounts grows slowly, but through a combination of compound interest and re-invested dividends, you can earn thousands of dollars by the time you clock out for the last time.

Of course, these accounts aren’t liquid until you retire. While you can withdraw money from them, that money will likely be subject to penalties and could be taxed in some cases. You’ll also miss out on earnings.

There are also no guarantees with retirement accounts. Your earnings will be subject to the whims of the market and economy in general, and your money won’t be backed by the FDIC or NCUA. Managed retirement accounts are subject to fees as well. You can self-manage your accounts, although this requires time, research, and know-how.

While you can withdraw money from retirement accounts, that money will likely be subject to penalties.

Investments

Stocks, bonds, index funds — most of the traditional tools you think of when you hear the word “investments” — generally earn better returns over time than high-yield savings accounts. But with that greater reward comes greater risk, as you could lose money on uninsured investments if they lose value that is not regained before you withdraw your money in retirement.

Some investments, such as bonds, lock up your money for a set term similar to certificates. But stocks, ETFs, and index funds are fairly liquid. Still, nothing beats a savings account for fast cash in a pinch.

It’s also easy to manage a high-yield savings account. It doesn’t require specialized knowledge, copious research, or much time. Also, the cost to open a high-yield account is often lower than the cost to start investing.

Managing a high-yield savings account doesn’t require specialized knowledge.

FAQs

You can open a high-yield savings account online or in person at the local branch of your bank or credit union. You’ll need:

- A state-issued ID

- Your Social Security number

- Date of birth

- Proof of address (such as a utility bill or credit card statement)

- Contact information such as your phone number and email address

- Your opening deposit

You can open a high-yield savings account at most banks, online banks, and credit unions. PenFed’s high-yield savings account is called Premium Online Savings.

Yes, you can withdraw or transfer money from your high-yield savings. However, some institutions may set a monthly limit on the number of withdrawals and transfers. Your account may also have a minimum balance you must maintain.

The Takeaway

A high-yield savings account can take your savings strategy to the next level. With a great rate and the right strategy, you’ll be hitting your savings goals in no time.

Get an Account to Help You Save Money Fast.

Open a PenFed Premium Online Savings account and start earning today.