FINANCE

What Are Quarterly Taxes?

EXPECTED READ TIME: 11 MINUTES

Maybe you’ve joined the gig economy for some extra income, selling your handicrafts online or delivering food (or people!) to destinations all over town. Or maybe you’re one of the 16 million+ self-employed workers in the U.S. who get to be their own boss. In either of these cases, Tax Day may come once per quarter instead of once per year.

But don’t let the notion of “extra tax days” keep you from going after that dream career, business, or gig that will get you to your goals. We’re here to help you get informed, figure out if quarterly taxes affect you, and strategize to help you stay current with your payments.

What Exactly Are Quarterly Taxes?

Traditional Tax Withholding vs. Quarterly Taxes

Why do some people have four Tax Days per year instead of one? Well, if you’re “traditionally” employed by someone else — you’re salaried or receive an hourly W2 wage — you probably have taxes withheld from your paychecks. That means that your employer takes money out of every paycheck for taxes and sends it to the U.S. Internal Revenue Service (IRS). In that case, you are actually making tax payments as many times per year as you receive a paycheck!

But if you earn self-employment income (you’re a business owner, a 1099 contractor, an online merchant, or a landlord, for example), then you may need to pay estimated taxes to the IRS four times per year. These payments are your federal “quarterly taxes.”

If you earn self-employment income, you may need to pay estimated taxes to the IRS four times per year.

We use the term “federal” here because this discussion focuses on quarterly taxes owed to the federal government, which is the domain of the IRS. If your income category requires quarterly payments of federal income tax, you may or may not need to also estimate and pay state taxes on a quarterly basis. Check out your state’s revenue site to determine how the state revenue agency handles income tax for people who are self-employed.

What Types of Income Are Subject to Quarterly Taxes?

For most people, any money earned as income is taxable. Self-employment income might be income from a business you own, freelance and 1099 contract work, side gigs (including tips), goods sold online, or rental payments. Your self-employment income is subject to both self-employment tax and income tax.

Other taxable income subject to quarterly taxes includes interest and dividends from savings and investments, alimony, capital gains, prizes, and awards. If you’ve earned or received any of these types of income, you’ll have to pay income tax, but not self-employment tax, on them.

What Makes Up Quarterly Taxes?

Quarterly taxes are comprised of two parts — self-employment tax and income tax — as follows:

Self-Employment Tax

The self-employment tax consists of both the employee and employer portions of Social Security and Medicare taxes. When you’re salaried or earn W2 hourly wages, your employer pays for half of these taxes. But when you work for yourself, you are responsible for the entire amount. The self-employment tax rate is 15.3%, which is the total of 12.4% for Social Security — old-age, survivors, and disability benefits — and 2.9% for Medicare, the federal health insurance for people 65 years and older.

The self-employment tax rate is 15.3%, which is the total of 12.4% for Social Security and 2.9% for Medicare.

Income Tax

This is the tax you pay on your income, just like the majority of the workforce. The rate you pay depends on your total income, which is taxed in accordance with pre-determined tax brackets.

Do I Need to Pay Quarterly Taxes?

A good rule of thumb is that you probably need to make quarterly estimated tax payments if both of these apply:

You run your own business and have made a profit, or you are an independent contractor. Other scenarios include earning a decent amount of income from freelance work, rental payments, or a side gig, in addition to your main job.

Your income is greater than your self-employment expenses. Self-employment expenses may include rent and utilities for a physical location, equipment, supplies, and services paid.

Is Any Self-Employment Income Exempt From Quarterly Taxes?

If your self-employment expenses are greater than your income, you do not need to pay quarterly taxes, because those expenses should be deducted from your income.

If you’re one of those workers who falls into a certain “not common” category you may see on tax forms and software — such as a calendar year taxpayer who earned at least 2/3 of your current or prior year income comes from farming or fishing — you probably don’t have to pay quarterly taxes.

If most or all of your income is from self-employment, it’s a good idea to set aside 25-30% of your income and profits to ensure you’ll have enough money to cover your tax payments.

Generally speaking, quarterly tax deadlines are mid-April, mid-June, mid-September, and mid-January.

When Are My Quarterly Taxes Due?

Generally speaking, quarterly tax deadlines for a given tax year are mid-April, mid-June, and mid-September of the given tax year for the first three quarters, and mid-January of the next year for the last quarter. The first quarterly tax deadline falls on the same day that most people must file tax returns: the “traditional” Tax Day. However, while everyone else is paying tax on income earned the previous year, you’ll be paying tax on income earned in the same year as the deadline (see the chart below).

Tax days for each subsequent quarter usually fall on the 15th day after the end of the quarter, unless that day is on a Saturday, Sunday, or holiday. The IRS may extend these deadlines during disaster situations.

Here are the deadlines for paying your 2025 estimated quarterly taxes on income:

| Quarter | Income From: | Estimated Taxes Due: |

|---|---|---|

| Q1 | January 1 – March 31, 2025 | April 15, 2025 |

| Q2 | April 1 – May 31, 2025 | June 15, 2025 |

| Q3 | June 1 – August 31, 2025 | September 15, 2025 |

| Q4 | September 1 – December 1, 2025 | January 15, 2025 |

What Happens if I Don’t Pay My Quarterly Taxes on Time?

The IRS does impose a Failure to Pay Penalty if you don’t pay your quarterly taxes by each quarterly deadline. The IRS imposes 0.5% penalty on the unpaid taxes for each month or part of a month the tax remains unpaid. The maximum penalty 25% of your unpaid taxes for that particular quarter.

But we want to help you avoid such penalties. One way to do this is to make sure to get a solid estimate of your quarterly tax amounts, and then pay your taxes on time.

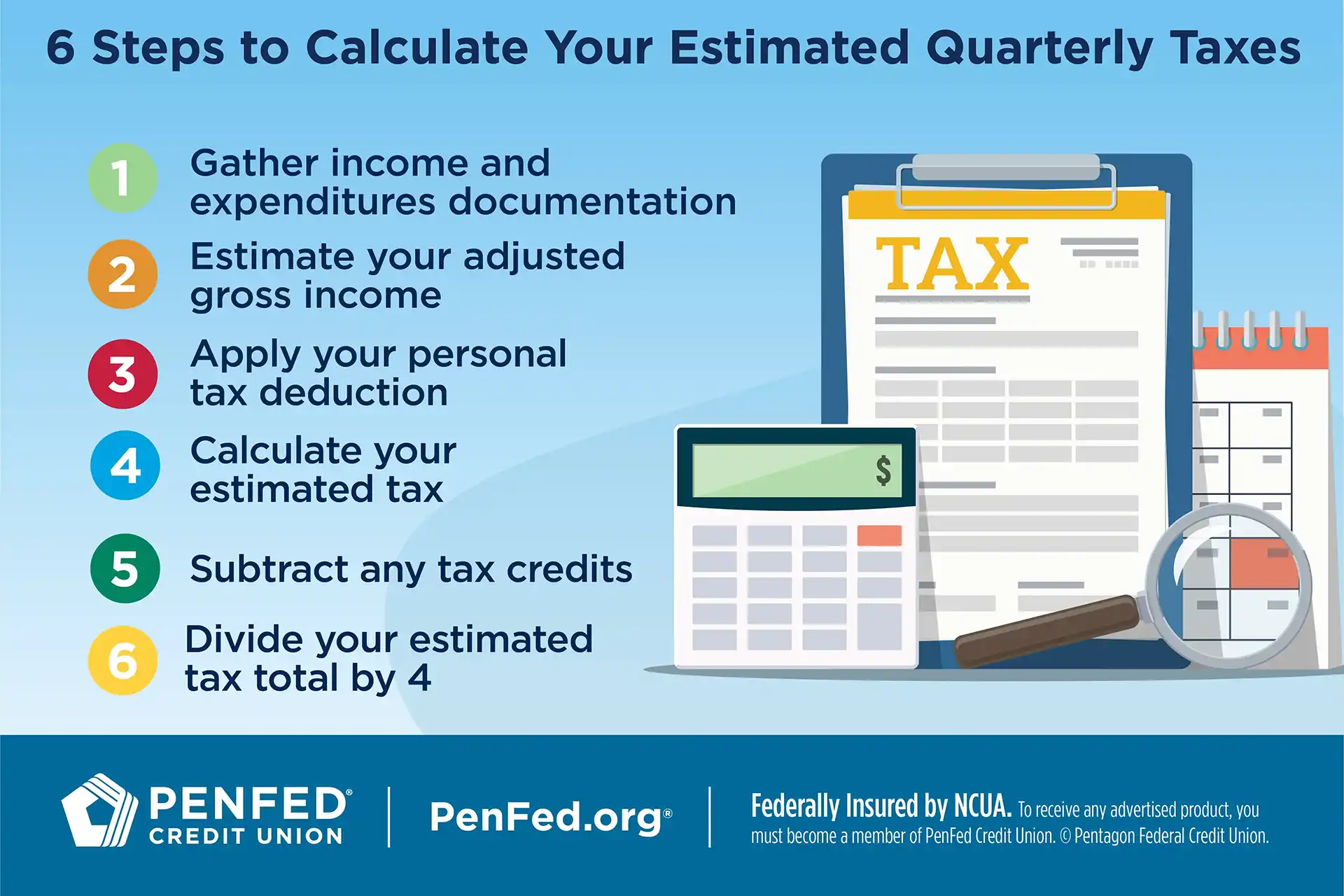

How Do I Estimate My Quarterly Tax Payments?

Now on to the calculations! But don’t worry — whether you love or hate number crunching, calculating your quarterly taxes doesn’t have to be a major burden. Put on some music or background noise — or even opt for a change of scenery at a locale of your choice — and get started by following these steps:

Step 1: Gather Your Documentation of Income and Expenditures

Make sure you have records of your income, as well as payments and expenditures, on hand. This includes documentation of 1099 pay, interest and dividends earned on savings and investments, retirement contributions, rental income, alimony paid to or by you, prizes and awards, capital gains, tax credits owed to you, and any other records of your income and deductions.

If you’re your own boss — at least part of the time — that means you’re also your own payroll specialist.

Another document that can be very useful for estimations is the IRS’s Form 1040-ES. You can use this form to determine a closer estimate of what you will owe. It can be particularly helpful to use this form:

- If your income is going to be around or above the Social Security taxable maximum

- If you will both have farm income and receive social security retirement or disability

- If any of your income will be subject to the Alternative Minimum Tax

- To make sure you factor in any and all tax credits

Step 2: Estimate Your Adjusted Gross Income for the Year

There are two general methods to estimate your income:

Method 1: Estimate Your Income for the Entire Year

If you expect to earn about the same amount this year as you did the previous year, you can use last year’s income as an estimate of your income. Otherwise, if you have a good idea of what you will earn this year from all sources, based on contracts, an hourly rate, projected investments, etc., you can use that number.

Method 2: Use Your Quarter One Earnings

If your self-employment and other income generally remains the same throughout each year, quarter-by-quarter, you can use your first quarter income (January 1 – March 31) as a base and multiply it by 4.

From the amount you figured using either Method 1 or Method 2, subtract any “adjustments” to your income, which includes pre-tax retirement plan contributions (such as to a traditional IRA or 401K plan), alimony payments paid by you, educator expenses, and student loan interest. You should also subtract any business expenses that you’re allowed to deduct from your income. Write down the result as your adjusted gross income (AGI).

If you are using Form 1040-ES, enter your AGI as the amount of taxable income and profits on line 1a of the Self-Employment Tax and Deduction Worksheet and line 1 of the Estimated Tax Worksheet.

Check out your state’s revenue site to determine how the state revenue agency handles income tax for people who are self-employed.

Adjusted Gross Income Example

Let’s assume the following scenario and estimate your AGI:

You file your taxes singly.

You are an independent contractor making an hourly rate of $40/hr. on a 1099 contract, and you expect to work for 2,000 hours this year. Using Method 1, you estimate that your income from this job for this year will be $40 × 2,000 = $80,000.

You estimate car-related business expenses of $600, home office expenses of $2,800, and computer and software expenses of $1,200. That’s a total business expense estimate of $600 + $2,800 + $1,200 = $3,600.

You also contribute $300 per paycheck to a traditional (pre-tax) IRA, and you are paid biweekly. That means you will contribute $300 × 26 = $7,800.

You create and sell ceramic goods, and sold $1587.50 worth from January 1 to March 31 of this year. Using Method 2, you estimate your income from such sales will be $1587.50 × 4 = $6,350

You estimate ceramic material costs of $600 and home studio costs of $1,000 for the year. Your estimated expenses for this business would then be $1,600.

In this scenario, your AGI would be $80,000 - $3,600 - $7,800 + $6,350 - $1,600 = $73,350.

Because this AGI is less than the Alternative Minimum Tax exemption amount for 2023 ($81,300), you won’t have to pay the AMT.

Step 3: Apply Your Personal Tax Deduction

We’ll continue with the example above, in which your AGI is $73,350.

Let’s now assume that your personal deductions (charity, mortgage interest, etc.) are less than the 2025 standard deduction of $15,000, so you use that rather than itemizing. That lowers the amount of your earnings subject to income tax to $73,350 - $15,000 = $58,350. Note that this does not lower your income amount subject to self-employment (Social Security and Medicare) tax.

Make sure you have records of your income, as well as payments and expenditures, on hand.

Step 4: Calculate Your Estimated Tax for the Year

Income Tax Estimate

Now apply the marginal rates for 2025 to each tax bracket that your taxable income of $58,350 is subject to. Apply a tax of:

10% on your first $11,925 of taxable income: 10% of $11,925 = $1,192.50

12% on your income amount between $11,925 and $48,475: 12% of $36,550 = $4,386

22% on your income amount over $48,475: 22% of $58,350 – $48,475 = 22% of $9,875 = $2,172.50

Your federal income tax estimate for the year is then $1,192.50 + $4,386 + $2,172.50 = $7,751.

Self-Employment Tax Estimate

Your self-employment tax is 15.3% of your AGI of $73,350 (do not subtract the standard deduction on this one). That’s 0.153 × $73,350 = $11,222.55

Your federal tax estimate total is then $7,751 + $11,222.55 = $18,973.55, which rounds to $18,974.

Step 5: Subtract Any Tax Credits

If you have children or fall into a lower income category, you can now subtract some tax credits.

Your income is higher than the earned income tax credit limit for 2025, but let’s assume you have one child. You can subtract a child tax credit of $2,000 for your child from your tax estimate to get $18,974 – $2,000 = $16,974.

Note that this amount is approximately 23% of your AGI of $73,350. That’s only a little less the 25-30% of your income that we suggest you set aside for your tax payments.

Step 6: Divide Your Estimated Total Tax by 4

This last step is very straightforward: $16,974 ÷ 4 = $4,243.50. This is the amount you should send to the IRS each quarter.

The IRS suggests making quarterly payments throughout each quarter, such as monthly or biweekly, to stay on track of your payments.

How Do I Send in My Quarterly Tax Payments?

Once you’ve calculated your quarterly tax amount, make sure to pay by each quarterly deadline. You can pay in any one of five ways:

1. The IRS’s Electronic Federal Tax Payment System (EFTPS)

The IRS touts the EFTPS as the go-to platform to pay all of your federal taxes. You must first enroll in the system, but after that you can use it to schedule, track, view, and change payments securely, 24/7. The IRS suggests making quarterly payments throughout each quarter, such as monthly or biweekly, to stay on track of your payments.

2. Direct Bank Account Payment

Another way to pay electronically is via Direct Pay from your bank account. You can also look up information about a payment that you’ve made, as well as modify or cancel a scheduled payment until two business days before the payment date. This service is available each Monday through Saturday from midnight to 11:45 PM EST and Sunday from 7 AM to 11:45 PM EST.

3. Debit Card, Credit Card, or Digital Wallet

Electronic payments can also be made using your debit card, credit card, or digital wallet, Note that these payments are made through third party processors, and may incur fees. The IRS’s page lists the fees and types of payments that are accepted.

4. IRS Online Account

You can pay via your IRS Online Account using your IRS username or your ID.me login information. If you do not have one of these, you can create an ID.me account. This account also allows you to view, manage, and track your payments, and to create payment plans.

5. Check or Money Order by Mail

If you prefer to pay by check or money order, you can send in your payment via U.S. mail. If you use this method, be sure to include form 1040-ES, and mail the form and your payment to the appropriate address, according to your location and situation.

The Takeaway

If you’re your own boss — at least part of the time — that means you’re also your own payroll specialist. Getting your taxes done right at the end of each quarter means that you’ll have the time, energy, and peace of mind to accomplish your business goals throughout the rest of the year.

Invest Your Tax Savings In a Money Market Certificate

Discover the diverse offering of products, services, and support available to our members.