Personal Finance

7 Reasons You Should Sign Up for a Personal Finance Course

What you'll learn: The benefits of taking a personal finance course

EXPECTED READ TIME:6 minutes

Taking a personal finance course may not sound like the time of your life, but it will have measurable, life-long benefits. Making good financial choices is the starting point for achieving many of the other things you want in life. Here’s how a personal finance course can make that happen.

Why Should I Take a Personal Finance Class?

There’s no magic switch that flips on when you hit your 18th birthday, activating good financial sense. Everyone has to learn how to earn and manage their money, just like you have to learn how to catch a baseball or do well on a test. Sure, you can learn the hard way, but taking a personal finance class will accelerate your learning and smooth some bumps along the way.

There’s no magic switch that flips on when you hit your 18th birthday, activating good financial sense. Everyone has to learn how to earn and manage their money.

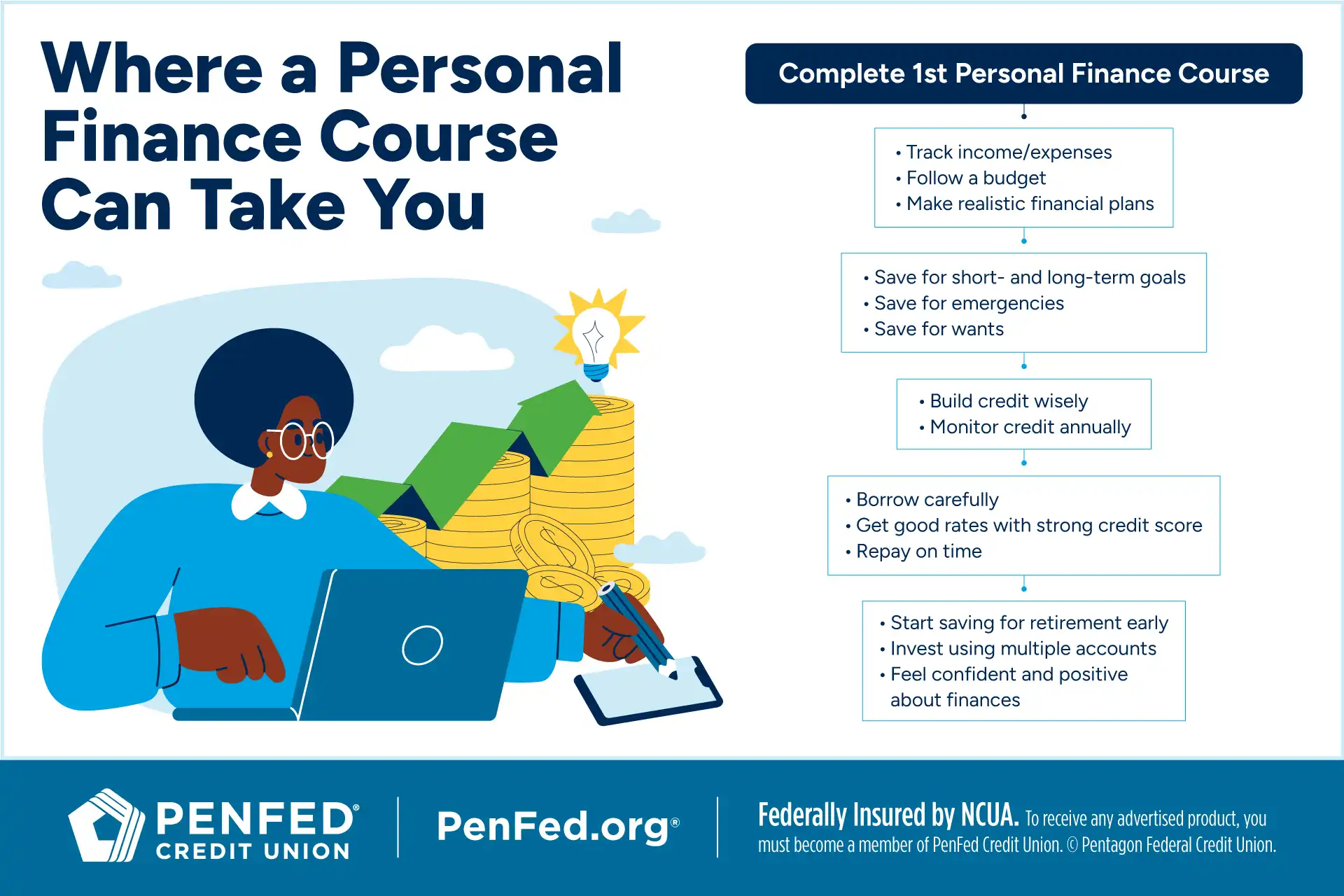

In a personal finance course, you’ll learn the basics of managing money, including:

- Budgeting: tracking your income and expenses, and making realistic plans for your money

- Saving: setting aside money for emergency expenses, long-term goals, and some of your wants

- Managing credit: how to establish it, improve it, and use it wisely

- Borrowing: choosing from different types of loans, evaluating the total cost, and repaying on time

- Investing: growing your savings and planning for retirement

Not convinced yet? Here are seven reasons why you should take a personal finance course.

1. Lead a More Stable Life

A May 2024 survey from MarketWatch revealed that two-thirds (66.2%) of Americans live paycheck to paycheck. That means that these people won’t be able to cover all their bills if they miss a single paycheck. That kind of financial instability can lead to stress, depression, trouble sleeping, and long-term health issues.

Adults who complete personal finance classes are substantially less likely to struggle with financial instability. In fact, they’re less likely to be behind on their bills and more likely to have above-average credit scores. They’re even more likely to start and finish college with below-average amounts of debt.

The differences between someone with financial literacy and someone without can be small. For example, someone with higher financial literacy is more likely to:

- Keep an emergency fund

- Automate their savings

- Keep their savings in interest-bearing accounts

Small differences like these can have huge effects. That emergency fund can help you avoid turning to credit cards or emptying your savings during layoffs. Automating your savings ensures you have good cash flow when juggling your bills, and that your interest-bearing accounts grow those savings at an accelerated rate. These little money habits relieve a lot of stress and allow more financially literate people to thrive.

These little money habits relieve a lot of stress and allow more financially literate people to thrive.

2. Start Early and Gain a Life-Long Advantage

Young adults who take a personal finance course are more likely to establish healthy money habits early, and those habits can add up to big gains over the course of their lives. Those who establish a savings habit and start contributing to retirement accounts earlier will end up with tens or even hundreds of thousands of dollars more in old age thanks to accumulation of compound interest or share dividends, stock and fund value increases, and paid stock dividends.

When it comes to retirement, time is the name of the game. Investments take time to grow, and the more time you give them, the more they will yield. But many people put off saving for retirement because they don’t feel they know how, especially if they don’t have access to employer-sponsored retirement accounts.

A personal finance class will teach you how to take advantage of retirement benefits your job may offer, but it will also explain other great options you can use to supplement those, or as a replacement if your job doesn’t offer a 401(k) or equivalent. Even understanding a few basic principles of investing puts you in control of a much brighter future.

3. Avoid Expensive Financial Mistakes

Mistakes happen, especially when you’re new at something. But you can dodge some of the worst — and most expensive — mistakes if you know a few basics, such as the difference between interest rate and APR or a fixed versus a variable rate. Understanding financial terms and how common tools like credit cards work will help you make informed choices that support your financial wellbeing.

In fact, a report from consulting firm Tyton Partners and Next Gen Personal Finance revealed that taking a one-semester personal finance class carries a lifetime benefit of $100,000 per student. The study suggested that the benefit came from savings on credit card debt, auto loans, and mortgages.

In 2000, Georgia, Idaho, and Texas implemented mandatory financial education for students. By the third year, credit scores had increased by 10.89 points in Georgia, 16.19 points in Idaho, and 31.71 points in Texas for students who had participated in the program. Since then, other states that have enacted similar programs have seen similar results.

Taking a one-semester personal finance class carries a lifetime benefit of $100,000.

Young adults who complete personal finance courses generally have significantly higher credit scores. Having a higher credit score not only increases your chances of being approved for credit cards and loans, but it can also help you:

- Qualify for a lower interest rate

- Avoid some fees

- Reduce the need for collateral

4. Protect Yourself from Predatory Practices and Scams

Another advantage to taking a personal finance class is you’ll know a good deal from a bad one — and a bad one from a really bad one. Predatory lenders take advantage of people who need to borrow money but don’t understand their options for borrowing. Their business is driven by misinformation, fear, lack of awareness, and sometimes desperation.

Borrowing and repaying debt is one of the pillars of personal finance education. You’ll learn about options for borrowing money, like personal loans and home equity loans, as well as important terms for evaluating loans, such as:

- Revolving vs. installment debt

- Variable vs. fixed interest rates

- Interest vs. annual percentage rate (APR)

Some predatory lending schemes, like payday loans, have been around long enough that you may be aware of their shady reputations. But when you understand how to read credit card statements and calculate the total cost of loans, you have the knowledge to identify new scams as they appear on the financial scene.

5. Banish Money Anxiety

A Bankrate survey from March 2024 reported that 47% of adults in the U.S. say that money concerns have a negative impact on their mental health. While some attributed that to economic factors, another survey from Bankrate shows that 59% of Americans don’t believe they have enough saved for emergencies (including economic downturns or periods of inflation).

Completing a personal finance course won’t shield you from every financial challenge you face, but knowing how to prepare, how to cut back, and how to recover from financial emergencies can relieve a lot of your stress. Being financially literate can improve your confidence and help you cope with financial anxiety in healthy ways.

6. Help Your Family and Friends

Personal finance classes don’t just help the person who takes them. They also help the family and friends of people who take them. That’s because when people make important discoveries about money, they share that information with people around them in what’s known as the “trickle up” effect.

The result of this sharing is thousands of dollars in savings spread across communities. And odds are, you know people who could use some informed guidance. A recent study from MarketWatch revealed that only 57% of U.S. adults are financially literate.

One personal finance course won’t make you rich, but when you understand the basics, you can think strategically and make better use of your funds.

7. Achieve the Life You Want

You’ve got goals, whether you’re planning for college, working for your dream car, or saving for your first apartment. Financial planning can make them happen. That’s not to say one personal finance course will make you rich, but when you understand the basics, you can think strategically and make better use of your funds.

After all, the goal of personal financial literacy is maximizing your financial potential. It establishes a firm foundation, and as you move up in your career, earn more, and learn more about money, you’ll be able to build a good life on that base.

FAQs

Personal finance classes can vary, with some being more comprehensive than others. Most will cover how to create and refine a budget, why and how to save, how to build and manage your credit, and how to repay debt you’ve borrowed. They may also cover concepts like compound interest, calculating your net worth, and paying taxes.

It’s possible to teach yourself personal finance through books, self-paced online courses, or free educational content from banks and credit unions. While there are some social media accounts offering financial literacy, always verify their information with other trusted sources.

The 5 basics of personal finance refer to the most essential skills you need for money management: budgeting, establishing and managing credit, repaying debt, saving, and investing.

The Takeaway

It’s never too late to become a more financially literate person. Completing a personal finance course is one of the best gifts you can give your future self.

Start Saving Today

Discover the diverse offering of products, services, and support available to our members.