FINANCE

Do I Need a Financial Advisor?

What You’ll Learn: Learn whether you need a financial advisor and how to choose the right one for your financial needs.

EXPECTED READ TIME: 8 MINUTES

Is this the year you vowed to finally organize your retirement investments and long-term finances?

Some people may be capable of knocking out a long-term financial strategy, but for many, the time to make it happen is beyond their schedules, energy, or confidence. If that sounds like you, it may be time to reflect and see if you need a financial advisor.

A financial advisor can bring fresh insights and solutions to your financial situation. Plus, a dedicated financial professional can help you with short-term goals and a long-term plan that preserves, manages, and builds on what you already have.

What Is a Financial Advisor?

“Financial advisor” is a catch-all term for professionals who can help you manage your finances. They may come from different backgrounds, hold different credentials, and provide different services based on their specialty, and they may work with individuals or groups.

Financial advisors can help you create a plan that's geared to meet your financial goals. These plans often focus on:

- Budgeting

- Saving for emergencies, education or training, and retirement

- Decision-making around life insurance and tax expenses

- Estate planning

Types of Financial Advisors

Financial advisors often specialize in certain services. Here’s a look at some of the most common types of advisors:

Financial Planner

A financial planner focuses on the big picture by providing assistance with short- and long-term financing, including budgeting, saving, insurance, taxes, and estate planning.

There aren’t consistent state or federal laws defining what a financial planner is or what services they offer. They may not be subject to any regulation if they only provide general financial advice, although some states do require registration and regulation if they sell insurance or offer investment advice.

Certified Financial Planner (CFP)

A CFP has met educational requirements and passed the CFP Board exam to earn certification. CFPs must also take continuing education to keep their certification current.

CFPs are also required to be fiduciaries, meaning they are legally required to keep their clients' best interests in mind. After assessing a client's financial profile, they must recommend resources that will benefit their client most. They often help clients devise a financial plan for managing investments and retirement, as well as insurance and taxes.

A CFA is distinguished as the "gold standard" for financial management.

Chartered Financial Analyst (CFA)

A CFA is distinguished as the "gold standard" for financial management. CFAs must meet steep educational requirements, have four years of professional experience, and pass three exams through the CFA Institute.

In their work, CFAs help clients with specialized assistance for short- and long-term financial goals, including relationship and wealth management, investing, asset allocation, and trading.

Investment Advisor

Investment advisors can go by a few names — brokers, asset managers, or portfolio managers. Their main job is buying and selling shares for investors. They can be individuals or brokerage firms, but they must be licensed.

While investment advisors aren't generally fiduciaries, they have a deep understanding of the markets and can provide advice to clients.

Wealth Manager

Wealth managers are similar to investment advisors in that they manage investments, but they also provide advice for retirement, estate planning, and taxes.

Typically, wealth managers work with people with a high net worth. Different wealth management firms set their own minimums for who they will work with, but requirements of $2 to $5 million are common.

Robo-Advisor

Robo-investors charge a percentage of the funds you invest, but they are generally less expensive than other options. You can work with a purely robot model or, for an additional fee, you can work with a hybrid model that includes access to a human financial advisor.

To get started, you’ll answer questions about your investment preferences, risk tolerance, and timelines for your goals. Then your answers are filtered through an algorithm to create a goal-aligned portfolio. From that point on, the robo-advisor monitors your portfolio and accounts, suggesting adjustments as needed.

Financial Advisor vs. Financial Planner

While these terms sound interchangeable, there are some differences. Financial advisors are often focused on a specific area of their clients’ finances such as estate planning or investing. Financial planners are more comprehensive, addressing many areas of their clients’ lives and providing overall plans for wealth management and growth.

There are also differences in how these professionals are paid. Financial advisors are usually paid through commissions on products and services they sell you, while financial planners generally take a percentage of the total assets they manage.

When to Consider Hiring a Financial Advisor

Finances tend to become more complex as you age, advance in your career, and build wealth. If this feels overwhelming or you worry about making the right choices, a financial advisor can help. For example, as you approach middle age, you may be juggling:

- A 401(k)

- Supplemental retirement accounts

- Health and life insurance

- Various debt

- Expenses (and savings) for your children

Financial advisors can also help if you and your partner struggle to agree on a financial strategy. Money is one of the most common sources of tension in relationships, affecting around three-quarters of American couples, and a professional will offer informed advice to move you past conflicts.

Financial advisors can help if you and your partner struggle to agree on a financial strategy.

You can work with a financial advisor on a long-term basis, but many also offer one-time or short-term consultations. Even people who don’t need an advisor on a day-to-day basis may find it helpful to work with one at certain life stages or during big life moments. You might choose to work with a financial advisor during:

Major Life Changes

Major life changes like marriage, divorce, the birth of a child, or becoming a caregiver can dramatically alter your financial priorities. A financial advisor can provide guidance and help you plan for the future.

Career Changes

Big career changes are a good time to work with a financial advisor. They can help you increase your savings or investing goals when you start a new job or get a promotion. They can help you cut expenses during lean times such as when leaving a job or starting a business. They can also guide you during the transition from full-time work to retirement.

Windfalls

Whether it’s an inheritance, a clever investment, or the lottery, your financial advisor can help you make smart decisions if you come into money unexpectedly.

Meet with a few before committing to work with one, and have some questions in mind to ask.

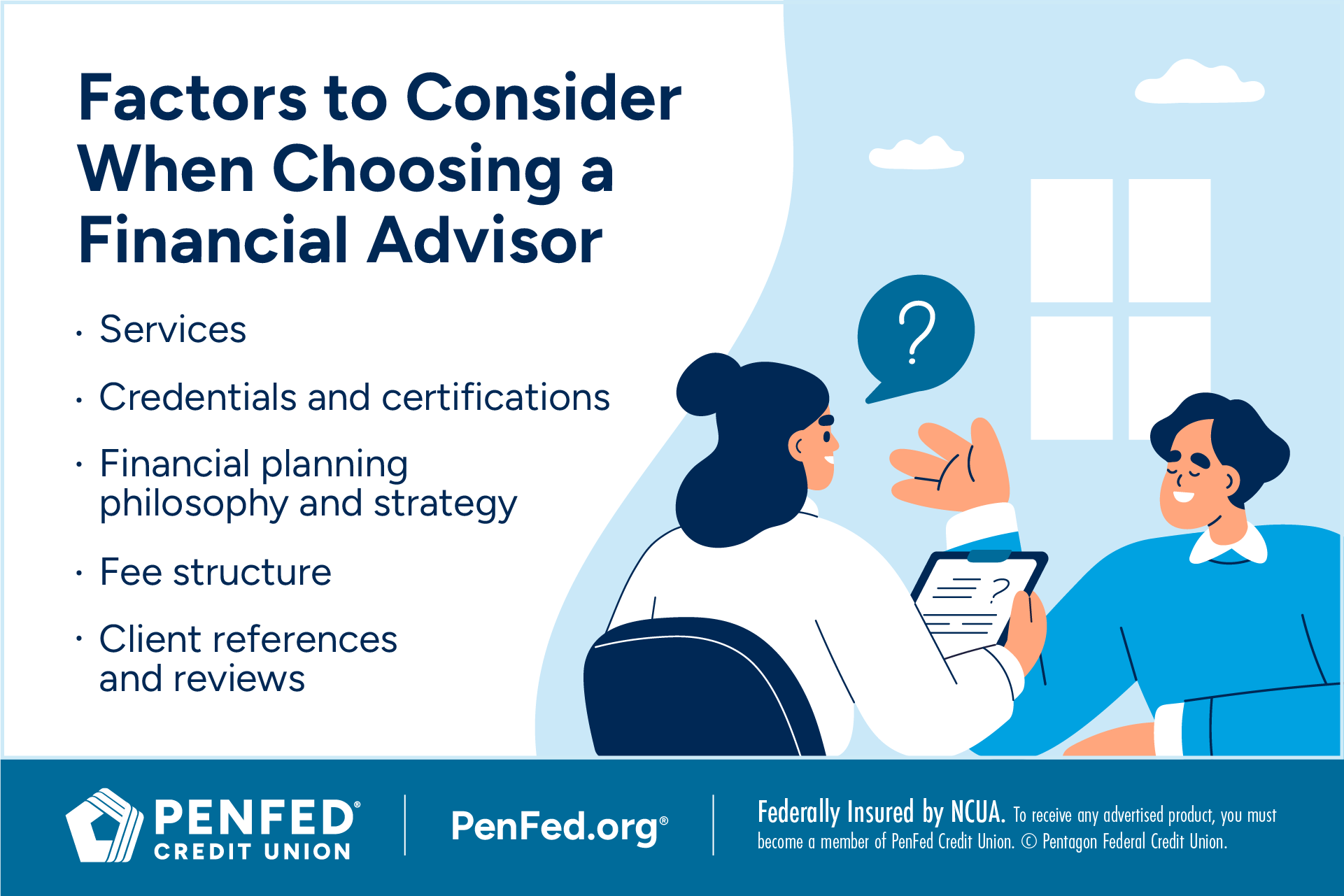

Factors to Consider When Choosing a Financial Advisor

Financial advisors commonly specialize in different areas of finance, but they’re also people with their own styles and preferences. You may find some easier to work with, and some may match your goals and philosophy more. Meet with a few before committing to work with one, and have some questions in mind to ask them:

Services

Start by asking what services they offer and where their expertise lies. It’s essential you work with someone who understands the area of finance that you’re seeking help with.

Credentials and Certifications

Ask what qualifications they have. Many advisors have degrees in areas such as accounting or finance, as well as certifications. Common certifications include Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), and Registered Investment Advisor (RFA), but there are also many others.

Financial Planning Philosophy and Strategy

You need to feel comfortable with your financial advisor’s approach. While you’re not an expert, you do know your finances and what will keep you up worrying about them. Choose someone you can trust.

Remember, a fiduciary is required to prioritize your best interests. It’s reasonable to ask potential advisors if they are fiduciaries.

Remember, a fiduciary is required to prioritize your best interests.

Fee Structure

Be sure you understand the fee structure advisors are using. Know the price, what it includes, and how frequently you will be charged. Get this information in writing.

Client References and Reviews

You’ll turn over lots of sensitive personal information to your financial advisor, and you’ll pay well for a good one. Before doing that, ask for reviews from current or former clients. Pay attention to complaints about poor communication, hidden costs, lack of transparency, and one-size-fits-all solutions.

Determining the Cost of Hiring a Financial Advisor

The cost of hiring a financial advisor can vary depending on what services you’re looking for and the fee structure they use. The most common structure is the AUM fee, which is based on a percentage of the assets under management — in other words, a percentage of the total value of money, investments, properties, and other assets they manage for you.

An AUM fee is usually 1% per year. With this model, your total fee will increase with the number of assets and value of assets your financial advisor manages. For example, if your financial advisor manages all $100,000 of your assets, then your fee will be $1,000 per year. If your financial advisor only manages $75,000 of your total assets, then your fee will drop to $750 per year.

Some financial advisors do use other fee structures such as:

- Flat annual rates

- Flat monthly rates

- Hourly rates

- One-time consultation fees, which usually run between $1,000 and $4,000

- Commissions

Another, less expensive option is using a robo-advisor. Robo-advisors usually charge an AUM fee of 0.25% to 0.50%, although some free options exist. The cost increases if you choose a hybrid model.

Pay attention to complaints about poor communication, hidden costs, lack of transparency, and one-size-fits-all solutions.

The Takeaway

Investing in a financial advisor can be a wise move, but it isn’t the right move for everyone. In some cases, you may just need to create a budget or commit to a debt payoff plan to get your finances in shape. But if your financial situation feels overwhelming, it’s good to know there are experts you can turn to for guidance.

Wealth Management Strategies for Each Stage of Your Life

Discover the diverse offering of products, services, and support available to our members.