Finance

Pros and Cons of Using a Personal Loan to Pay Taxes

EXPECTED READ TIME:4 minutes

A personal loan can be a great way to pay your income taxes. By providing a lump sum of cash fast, personal loans help you pay your unpaid taxes quickly and avoid penalties and higher interest rates. They’re also cheaper and more accessible for borrowers than many other options.

Now that tax time is here, we’ll help you determine whether using a personal loan to pay taxes is right for you. But don’t forget to consult a licensed tax professional for the most up-to-date information on taxes and tax laws — and do keep in mind that PenFed does not offer personal loans for paying taxes.

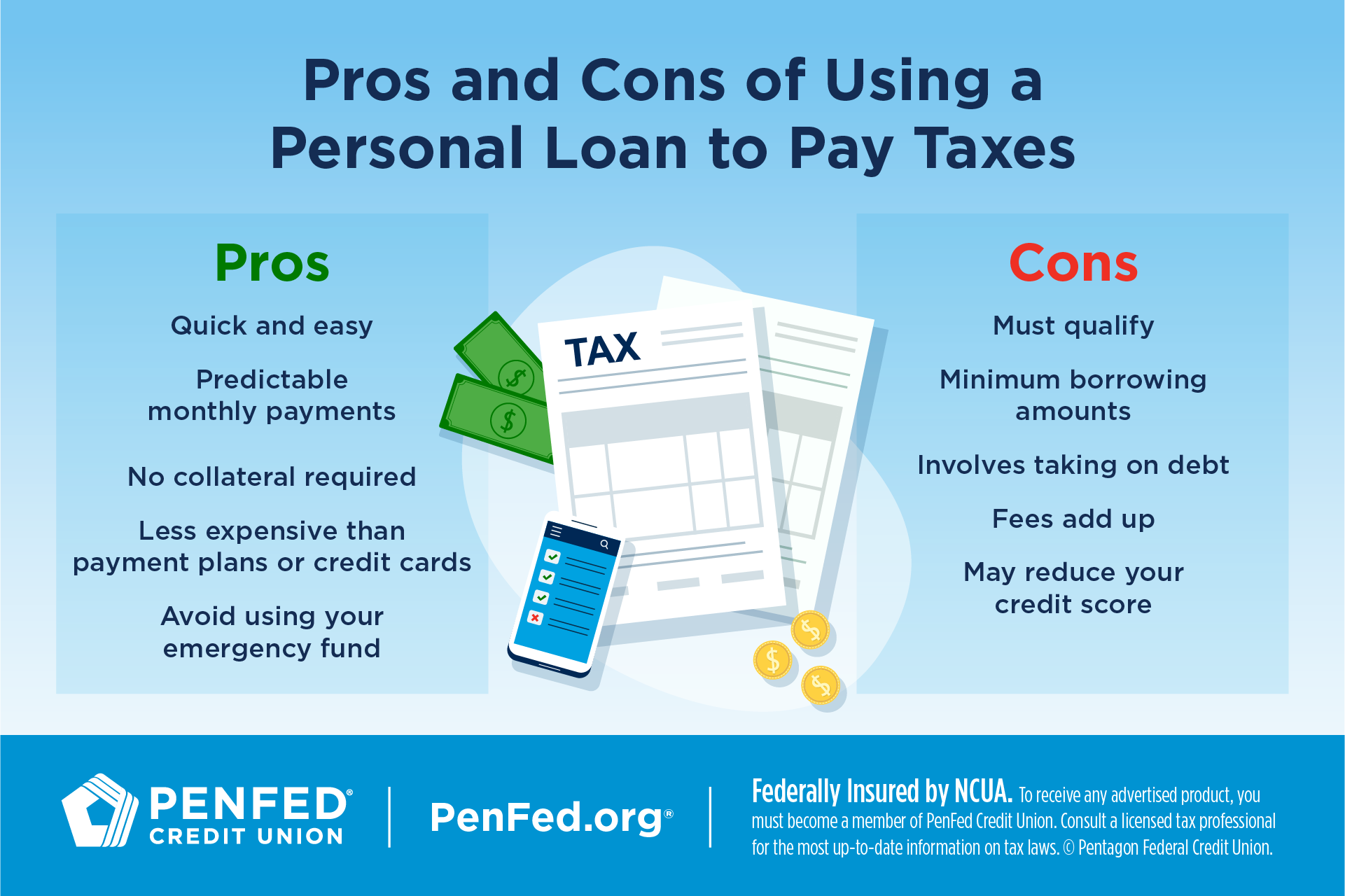

5 Benefits of Using a Personal Loan to Pay Taxes

There are a lot of advantages to using a personal loan to pay taxes. Here are just a few:

- It’s a quick and easy solution

- You’ll have predictable monthly payments

- No collateral is required

- A personal loan is less expensive than a payment plan or credit card

- You can avoid using your emergency fund

1. Quick and Easy

Applying for a personal loan is a quick process, and you can often complete the application in minutes online. Once approved, you could receive your funds in as little as 24 hours, depending on the lender, and then pay when you file your tax return — or even before, if you estimate your income taxes.

2. Predictable Monthly Loan Payments

Personal loans are easy to budget. With a set interest rate and term, you know from the beginning what you’ll owe each month — you can often choose from different short-term or long-term payment plans. This makes budgeting easier and helps you manage your cash flow more effectively.

Personal loans are usually unsecured, meaning you don’t have to put up collateral to back the loan.

3. No Collateral Required

Personal loans are usually unsecured, meaning you don’t have to put up collateral to back the loan. This is great for borrowers who don’t have collateral, and many borrowers feel safer using an unsecured loan than borrowing against their house, car, or other property.

4. Less Expensive

You can pay your tax bill using credit cards or with a repayment plan set up with the Internal Revenue Service (IRS), but these methods can be expensive. IRS payment plans include application and setup fees, and your balance accrues penalties and interest until it is paid in full. Similarly, the average credit card interest rate is 22.80% for existing accounts. All that interest means you could pay much more overall by paying your taxes this way.

Borrowers with good or excellent credit (usually a score of 690 or higher) may find interest rates as low as 7% on personal loans.

However, borrowers with good or excellent credit (usually a score of 670 or higher, depending on the lender) may find interest rates as low as 7% on personal loans. Even if your credit score isn’t quite that high, personal loans offer more competitive rates than other unsecured debt. You may also qualify for special interest rates by borrowing from a bank or credit union that you’re already a member of.

5. Avoid Using Your Emergency Fund

Emergency funds are an important way to protect yourself against unexpected financial emergencies like job loss or illness. If you’ve been able to tuck away a sizeable amount, then paying your taxes from this fund may be smart. But if you’re still building your emergency fund, then you can use a personal loan and avoid depleting your safety net.

5 Cons of Using a Personal Loan to Pay Taxes

Although there are a lot of benefits to using a personal loan to pay taxes, it’s not the right method for everyone. If you’re thinking about using a personal loan for your tax bill, there are a few things you should think about:

- You still need to qualify

- There are minimum borrowing amounts

- You’ll take on more debt

- Fees can add up

- It may reduce your credit score

You should also know that some financial institutions — like PenFed — do not offer tax loans

You should also know that some financial institutions — like PenFed — do not offer tax loans.

1. You Must Qualify

Most lenders require borrowers to have a credit score of 580 or better, plus verifiable income to qualify for a personal loan. Lenders may also consider other factors like your debt-to-income ratio.

2. Minimum Borrowing Amounts

Many lenders require you to borrow a minimum amount to be eligible for a personal loan. This means you could end up borrowing (and paying interest on) more than you actually need, raising the total cost of paying off your taxes.

3. Taking on Debt

Taking out a personal loan can increase your credit utilization rate and debt-to-income ratio, making it difficult to open new lines of credit or land the best interest rates until your loan is repaid.

You could end up borrowing (and paying interest on) more than you actually need.

4. Fees Add Up

Personal loans often come with fees. These usually include an application fee and an origination fee and could also involve penalty fees for prepayment or late payments. Make sure to calculate the cost of fees and interest charges when deciding whether taking out a personal loan is the right way for you to pay your taxes.

5. May Reduce Your Credit Score

In some cases, a personal loan can help your credit score. However, increasing your credit utilization rate can temporarily lower your credit score. So can missed or late payments.

The Takeaway

No one wants to find out they owe money toward their taxes. But if this happens to you, you have options for taking control and paying off this debt. You can avoid excess fees and high interest rates by choosing a proactive solution (like a personal loan).

If You Need a Personal Loan for Something Else…

Discover the diverse offering of products, services, and support available to our members.