Finance

How to Switch Banks or Credit Unions

What you'll learn: How to choose a new bank or credit union and how to close your old accounts.

EXPECTED READ TIME:7 minutes

Financial services are among the most important services you receive. A good financial institution is central to your financial wellness, which is why it’s important to switch banks or credit unions if your current one isn’t meeting your needs. The process of changing financial institutions is actually a lot more straightforward than you might realize.

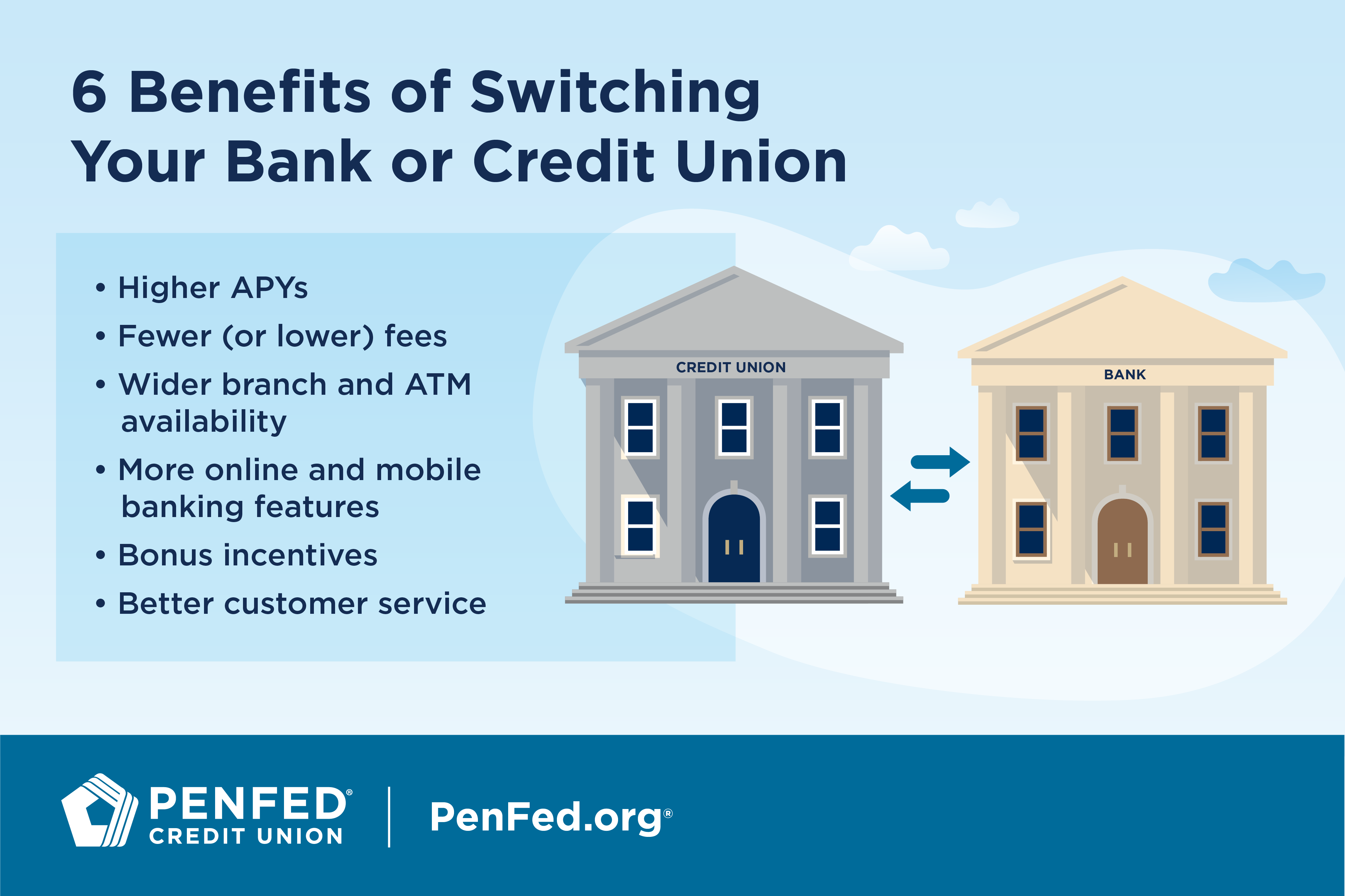

Is Switching Banks a Good Idea?

Changing your bank or credit union takes some legwork, but it can be worthwhile if changing leads to more convenience — or more money in your pocket.

Higher Annual Percentage Yields

According to the FDIC, the average APY on savings accounts in 2024 is 0.46%. However, the accounts with the most competitive rates can earn 10 times higher than that. If the APY on your savings isn’t keep pace with inflation, it might be time to move your savings somewhere it can earn more.

Keep in mind that you can earn an APY on some checking accounts, like PenFed’s Access America Checking. With interest-bearing checking, you can have all of your money working for you, all of the time.

Fewer (or Lower) Fees

Service fees on checking accounts add up fast. Thankfully, many banks and credit unions offer free checking. Others will waive fees if you meet certain conditions like maintaining a minimum balance, enrolling in direct deposit, or signing up for e-statements.

It’s not just service fees you need to watch out for, though. Look for an account that doesn’t nickel and dime you for regular transactions, withdrawals, or account transfers. You can also save by choosing a bank or credit union that offers fee-free ATMs.

Look for an account that doesn’t nickel and dime you for regular transactions.

Wider Branch and ATM Availability

Maybe your bank had lots of close locations when you first opened your account, but now the nearest branch is over an hour away. Or maybe you’re limited to a handful of ATMs that aren’t conveniently located. Whatever the case, your life will be simpler with easy access to your financial institution.

More Online and Mobile Banking Features

From making mobile deposits to transferring funds and paying bills, you can do most of your day-to-day banking from your laptop or phone — if your bank or credit union offers robust digital banking tools. There’s no good reason to miss out on benefits such as:

Real-time monitoring

24/7 account access

Zelle for peer-to-peer payments

Bonus Incentives

Many financial institutions offer incentives for new members. These incentives usually have certain requirements. For instance, you may need to open a checking and savings account at the same time, or you may need to enroll in direct deposit. Some incentives can add up to hundreds of dollars — a nice bit of change to pay down some bills or build up your savings.

Better Customer Service

No one wants to experience long wait times at branches or endless transfers on the phone. Many banks and credit unions are employing new tools to provide better customer service, including chatbots, online FAQ pages, and video tutorials. These tools help members to answer their most basic questions with little or no wait.

Another important part of customer service is clear communication about bank or credit union policies.

Another important part of customer service is clear communication about bank or credit union policies. A great reason to switch financial institutions is to find one that provides up-to-date, plain language explanations of their products and services. That’s a financial institution that values empowering their members.

Steps for Changing Banks or Credit Unions

1. Choose Your New Bank or Credit Union

Determine what you’re looking for in a new bank or credit union by thinking about the things you do and don’t like about your current one. Review your account statements and reflect on what you really need from your financial institution.

Review your account statements and reflect on what you really need from your financial institution.

Banks, Online-Only Banks, and Credit Unions

There are three main types of financial institutions to choose from: banks, online-only banks, and credit unions. While all three carry similar types of accounts, there are important differences you should think about, like whether you need a physical branch to visit and if membership is important to you.

Checking Account Types

Most financial institutions offer a few different checking account types catering to different needs. Whether you choose free checking or opt for a dividend-bearing account like PenFed’s Access America, there are a few standard things to consider when choosing a new account:

Checking account fees

Minimum balance requirements for checking and savings

Dividend/interest rates on interest/dividend-bearing accounts

Limits on monthly transactions

Mobile banking features

Access to ATMs and branches

2. Open Your New Account

You can still open a new account in person at a local branch, but most financial institutions will also let you open an account online or over the phone. How ever you choose to do it, you’ll need to have some personal information available:

Full legal name

Date of birth

Social Security number

Phone number

Home address

Email address

Driver’s license or government-issued I.D.

Employment information

You’ll also need your current checking account number and the routing number of your bank or credit union if you decide to transfer funds to it electronically. If you open your account in person, you can use a certified check or cashier’s check to move your money instead.

Enrolling in online and mobile banking involves creating a user I.D. and password, downloading your bank or credit union’s mobile app, and opting in to two-factor authentication.

3. Set Up Online Banking and Link Your Accounts

Enrolling in online and mobile banking involves creating a user I.D. and password, downloading your bank or credit union’s mobile app, and opting in to two-factor authentication. After these simple steps, you’ll be able to manage your accounts anytime, anywhere.

4. Update Any Automated Banking Features

Review your account statements and make a list of any automated transactions involving funds entering or leaving your accounts. These might include:

Direct deposits from your job, government benefits, alimony, or child support

Bill pay for things like your mortgage, utilities, car loan, or student loans

Transfers to savings or retirement accounts

Sporadic expenses like annual subscriptions or quarterly memberships

Some banks and credit unions offer a “switch kit” that helps you transfer your money, change direct deposits, and start bill pay. Be sure to update your payment method a few days before money is scheduled to enter or exit your account so the systems processing your payments have time to update with the new information and your payments won’t be affected.

Be sure to update your payment method a few days before money is scheduled to enter or exit your account.

5. Gather Your Account Records

Generally, you should keep checking and savings accounts statements for a few months at a time, disposing of them quarterly. But in some cases, you might want to keep statements from your old account until after the next time you file taxes. You’ll need to download these from your bank or credit union’s website if you’ve signed up for e-statements.

6. Close Your Old Account

There’s no limit to the number of checking and savings accounts you can open. If you’re simply opening a new account to take advantage of better rates or incentives, then you don’t have to close your old account.

But if you do decide to close your account, wait a month or two. It can take time to get your new direct deposits, bill pay, and transfers set up, and a small amount of money in your old account will cover any expenses you may have overlooked.

There’s no limit to the number of checking and savings accounts you can open.

Contact your old bank or credit union to find out their policy for account closures. Some institutions require that you request in writing that your account be closed, while others will close your account in a branch, online, or over the phone. Be prepared to show I.D.

Get written confirmation that your account has been closed and keep this with your other financial records. Destroy any debit cards or checks related to the account to prevent identity theft.

Closing Joint Accounts

A joint checking account is an account shared by two or more people whose names are each on the account. Different financial institutions have different rules for closing joint accounts. In some cases, only one person’s signature is needed to close a joint account. In other cases, each person on the account must sign to close it.

Usually, you don’t have to close a joint account in person. And often account holders can sign separately at different times to close an account. Contact your financial institution and ask how they handle closing joint accounts.

FAQs

Switching banks can be time-consuming, but it isn’t difficult. It does require that you communicate with your old bank or credit union and document your request to close your account.

You can open a new checking account in minutes online, although researching and finding the right bank for you can take between hours and weeks. You’ll also need to factor in time for changing any direct deposits or online bill payments you have set up. Closing a checking account can take as little as a few minutes or as long as a week, depending on your bank or credit union’s policy and whether you close the account in person, online, or by mail.

Switching banks or credit unions — or opening a new account and closing an old one — may or may not affect your credit score. For example, if taking out a loan is part of your switch, a hard inquiry may be part of the process. Check with your specific institution to know for sure.

Your checking and savings account activity is not reported to credit bureaus and will not appear on your credit report. The exception is if you close an account with a negative balance. In this case, your bank or credit union could report you to a collections agency if you don’t pay off your balance, and that could end up on your credit report.

Your credit score can also take a hit if you forget to update your automatic payments and miss or make late payments.

The Takeaway

Changing your bank or credit union isn’t as complicated as people think. The benefits are well worth the few clicks or calls it takes to start banking better.

Ready to Switch?

Discover the diverse offering of products, services, and support available to our members.