CHECKING/SAVINGS

Certificate Accounts vs. Other Savings Accounts

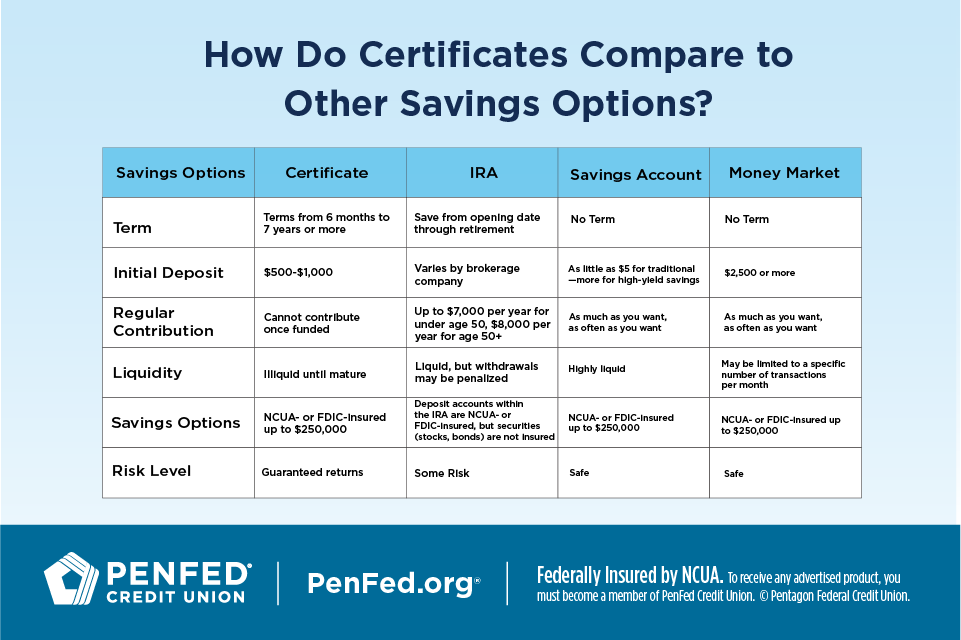

What you'll learn: How certificates compare to other savings options

EXPECTED READ TIME: 6 MINUTES

If you have enough money set aside to add funds to a savings account, you're already taking smart steps toward setting money goals. But did you know there are accounts that can help you maximize your savings? Read on to see how certificate accounts stack up against other savings accounts.

Certificates vs. IRAs

Individual retirement accounts (IRAs) are a popular way to save and invest for retirement. There are different types of IRA accounts to support different savings goals, but the most popular for individuals (as opposed to small businesses) include traditional and Roth IRAs. Here are some things to consider when comparing certificate accounts to IRAs.

Certificate Accounts

With a certificate account, you choose the length of your term (usually, a few months to a few years) and make a required initial deposit at a locked-in rate. Then your money earns dividends throughout the term.

With a certificate account, you choose the length of your term and make an initial deposit. Then your money earns dividends throughout the term.

Generally, the longer your certificate term is, the higher your earnings may be, which is great if you're saving for a long-term goal like retirement. When your certificate matures, you can withdraw the principal and interest or even step up your earning potential by laddering your certificate.

Certificate accounts are recognized as some of the safest investment options that also offer guaranteed returns. They’re included in the $250,000 (per customer, per institution) that is insured by the National Credit Union Administration (NCUA) for credit union members or the Federal Deposit Insurance Corporation (FDIC) for banks.

Unlike with IRAs, you don't contribute on a regular basis to most types of certificates (add-on certificates are an exception), and unless you're willing to pay an early-withdrawal fee, you'll leave your money in your account until it matures.

IRAs

An IRA is an account that's used specifically for retirement savings, can hold investments within it, and offers tax advantages. Whereas a certificate account earns interest over a specific term, an IRA accumulates earnings over the time it takes an investor to reach retirement, and you can make contributions all the while.

In general, IRA returns are determined by how well investments within the account perform. The two most common types of IRAs are traditional and Roth accounts.

With a traditional IRA, you can make potentially tax-deductible contributions. Earnings may potentially grow tax-deferred until you withdraw them, but any withdrawals you make in retirement will be taxable as income.

On the flipside, your contributions to a Roth IRA are taxed (meaning they aren’t tax-deductible), but withdrawals in retirement are tax-free. As with traditional IRAs, your funds in a Roth IRA may potentially grow tax-free.

With certificates, you have the option to open an account jointly — for example, with a spouse or child — while IRAs can only be opened by individuals. Additionally, IRAs typically aren't insured by the NCUA or FDIC. If you want to get the best of both, consider how a certificate is a type of investment that can be held within an IRA.

Contributions to a Roth IRA are taxed upfront, so withdrawals in retirement will be tax-free.

Certificates vs. Traditional Savings Accounts

Like certificates, traditional savings accounts are offered by banks or credit unions, where they may be referred to as share accounts. Although certificates and savings accounts are both federally insured, there are some key differences.

You can access savings account funds more easily and frequently than you can access money in a certificate account, but you won’t earn as much on your money.

Certificate accounts tend to earn at a lower rate than other types of market investments, such as stocks, bonds, and mutual funds, but savings accounts usually pay interest at even lower rates than certificates.

In contrast to certificate accounts, which usually require minimum deposits of $500 or $1,000, you can start a savings account with far less money up front, if anything at all.

A savings account holder can typically make up to six withdrawals or transfers a month, while a certificate holder is generally required to lock in money to an account for the duration of a selected term until maturity. Savings accounts don't have maturity terms.

And because you can access the funds in it whenever you need them, a traditional savings account can provide a versatile space to grow your savings for a variety of financial needs, from covering short-term expenses to building an emergency fund.

High-Yield Savings Accounts

Wondering if there's a way to stick with a savings account but earn a better return? Consider a high-yield savings account.

With a high-yield savings account, you may potentially earn interest or dividends at a rate that's 10-25 times higher than that of a traditional savings account thanks to a bigger initial deposit. Most often, you can even open a high-yield savings account at the same financial institution where you have your other accounts, making it easier to save with automatic transfers to savings.

With a high-yield savings account, you may potentially earn interest or dividends at a rate that's 10-25 times higher than that of a traditional savings account.

Certificates vs. Money Market Accounts

Similar to certificates, insured money market accounts (MMAs) are often seen as a lower-risk approach to saving. Both types of accounts often require a minimum deposit and can be opened at most banks and credit unions.

What's the difference between certificates and money market accounts? For one, MMAs are somewhat like a blend of checking and savings accounts. You can access the funds in your MMA with an ATM or debit card, check, or electronic transfer while earning dividends on your balance.

Money market accounts are a blend of checking and savings accounts.

This kind of accessibility differs from that of most certificates, which again, require you to store your money for a specific term ranging from several months to five or more years. Removing your money from a certificate early will result in an early withdrawal fee.

While MMAs earn interest or dividends, certificates may potentially earn more. While certificates have fixed rates, the rates on money market accounts may fluctuate.

When It Makes Sense to Open a Certificate Account

Not sure if opening a certificate account can help you meet your unique financial needs? Take a moment to think about your money goals, risk comfort level, and savings timeline.

Money Goals

Offering an element of versatility, certificate accounts provide a way to save for specific short- and long-term goals. Common short-term needs you could use a certificate account for include:

- Events such as a wedding or vacation

- A new car

- A down payment on a home

You could also use a certificate to save for long-term needs, such as higher education expenses and retirement funding.

Certificate accounts provide a way to save for specific short- and long-term goals.

Risk Comfort Level

Considered one of the safest investments, certificates are federally insured. They offer account holders a low-risk way to save, and they're still likely to earn at a higher rate than savings and money market accounts.

Savings Timeline

Certificates offer terms as short as six months and as long as seven years or more. You can easily choose a term that meets your needs.

The Takeaway

Certificate accounts, IRAs, savings accounts, and money market accounts all have distinctive features that can help you effectively build your savings. The right one for you depends on your risk tolerance, how much you want to save, and how quickly you want to get to your goals.

Invest in Your Future

Explore certificate accounts to find the best option for you.