Finance

Are Personal Loans Tax Deductible?

EXPECTED READ TIME:5 minutes

So, you took out a personal loan earlier in the year to consolidate debt, and you currently have a better grip on your monthly finances.

Now, with tax season inching closer, you’re wondering how the money you borrowed will (or won’t) impact your income taxes.

You should always consult a licensed tax professional for the most up-to-date information on tax laws. In the meantime, we've got some great tips to get you thinking about the possibilities.

Are Personal Loans Tax Deductible?

Generally speaking, personal loans are not tax deductible. The same goes for the interest you pay on the money you borrow.

That means if you take out a personal loan to finance your wedding, pay for a dream vacation, or fund just about any type of personal expense, you can’t claim the monthly payments or the interest charges on your annual tax returns as a way to reduce your overall tax liability.

On the other hand, since the Internal Revenue Service (IRS) doesn’t view the cash you receive from a personal loan as income, you don’t have to pay taxes on the funds. It’s essentially a wash from a tax standpoint.

The interest you pay on a business loan usually does qualify for a tax deduction.

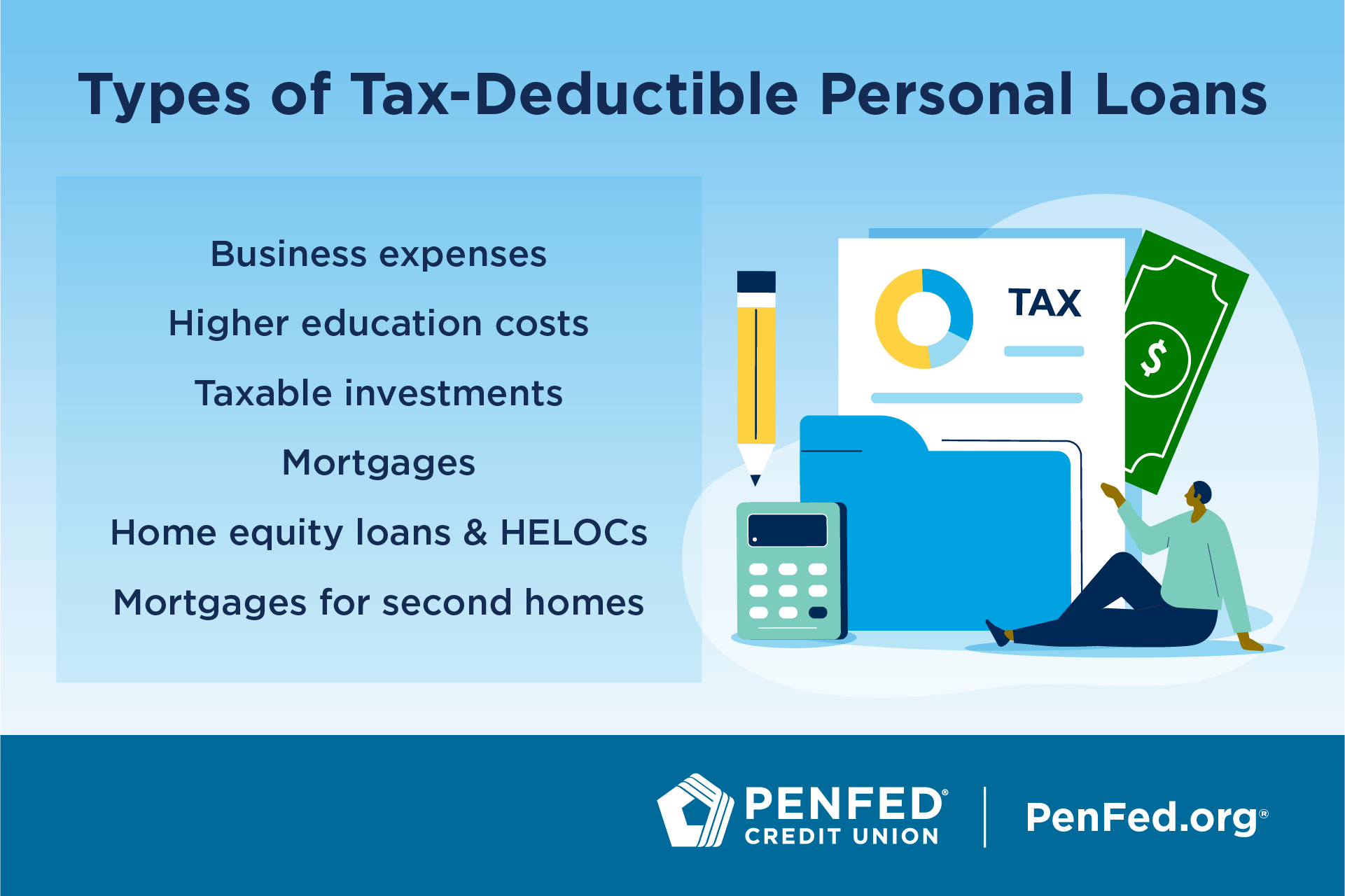

Exceptions to the Rule

As with most things related to tax code, the “standard” rule for unsecured personal loans has a few exceptions. The money you borrow may be eligible for tax deductions when it’s used for:

Business Expenses

If you take out a personal loan to pay for business expenses or to purchase a vehicle for business-related uses, you can deduct some or all of the interest you pay on the loan from your taxes, which may give your tax refund a boost. The only catch is the loan has to be made by a “legitimate” traditional or online lender.

Higher Education Expenses

In certain situations, you can deduct the interest you pay on a personal loan if the funds are used for qualified higher education expenses (tuition, fees, related expenses) or to refinance a student loan. To qualify, the loan must be for you, your spouse, or a dependent, and you’ll need to itemize your deductions on your tax returns to claim the interest charges.

Generally speaking, personal loans are not tax deductible.

Taxable Investments

If you use funds from a personal loan to purchase taxable investments like stocks, bonds, or mutual funds, the interest you pay may qualify for an investment interest deduction. However, you’re only allowed to claim what you earned from the investment (at the same rate that you’d pay on ordinary income) rather than the total amount of the account. Note that you may not be able to claim this interest deduction if you’re subject to the Alternative Minimum Tax (AMT).

What Types of Loans Are Tax Deductible?

Although personal loans are typically not tax deductible, other types of loans are. The following loans may lower your tax liability and should be claimed on your annual returns:

Mortgages

The IRS allows you to deduct up to $750,000 of the interest you pay on your home loan if you’re a single filer or married and filing jointly (limit is $375,000 per person if you’re married and filing separately). Higher limitations ($1 million, or $500,000 if married filing separately) apply to mortgage interest deductions from indebtedness incurred before December 16, 2017. Be sure to consult a licensed tax professional for the most up-to-date laws.

Home Equity Loans and HELOCs

You may deduct interest paid on a home equity loan or home equity line of credit (HELOC), provided you used the funds to buy, build, or substantially improve the home that was listed as collateral for the secured loan.

Mortgages for Second Homes

You can only deduct up to $750,000 in total mortgage interest if you are single or married filing jointly (or $375,000 if you’re married filing separately). You may be able to deduct interest on a mortgage on a second home if you haven’t exceeded that threshold with your first home, and if you use your second home as a personal residence.

Your main concerns should be using the money wisely and making your payments on time.

Student Loans

You’re allowed to deduct up to $2,500 each year for interest paid on any federal or private student loans that you take out for yourself, your spouse, or a dependent.

Business Loans

The interest you pay on a business loan usually qualifies for a tax deduction, as long as it meets these criteria:

- You get the loan from a credible lender like a credit union or bank rather than from a family member or friend.

- You use money from the loan for legitimate business expenses instead of just letting it sit in your bank account.

When Personal Loans Are Taxable

While personal loans are usually not taxable, you will owe taxes if your lender forgives some or all of the debt because you’re unable to make your payments. This creates cancellation of debt (COD) income.

For example, if you took out a $15,000 personal loan for home improvements and were only able to repay $10,000 because you fell on hard times, your lender might choose to forgive the remaining $5,000 of debt. That $5,000 would then be viewed as income by the IRS, so you’d receive a 1099-C from your lender, and you’d have to report that amount on your tax return.

If you own a second home, you might be able to deduct the mortgage interest paid on it.

Personal Loan Tax FAQs

Do You Pay Taxes on a Personal Loan?

In most cases, you don’t have to pay taxes on a personal loan because the funds aren’t considered income. However, if you default on your loan and the lender forgives some or all of your debt, you’ll have to pay taxes on that amount.

Is Interest on a Personal Loan Tax Deductible?

Unless you use a personal loan to pay for qualified business expenses, finance higher education costs, or purchase certain types of investments, the interest you pay isn’t tax deductible.

Is a Personal Line of Credit Tax Deductible?

From a tax standpoint, a personal line of credit falls into the same category as a personal loan, which means you can’t deduct the interest you pay on your annual tax returns.

Do Personal Loans Offer Any Tax Advantages?

By and large, personal loans don’t provide any direct tax advantages. Then again, they don’t negatively impact your taxes, either.

A personal loan typically doesn’t impact your taxes one way or another.

The Takeaway

Fortunately, the money you borrow with a personal loan typically doesn’t impact your taxes one way or another.

Your main concerns should be using the money wisely and making your payments on time, every time.

It’s a small price to pay for financial peace of mind when you tap into the spending power that a personal loan can provide.

Learn More About Personal Loans from PenFed