CREDIT CARDS

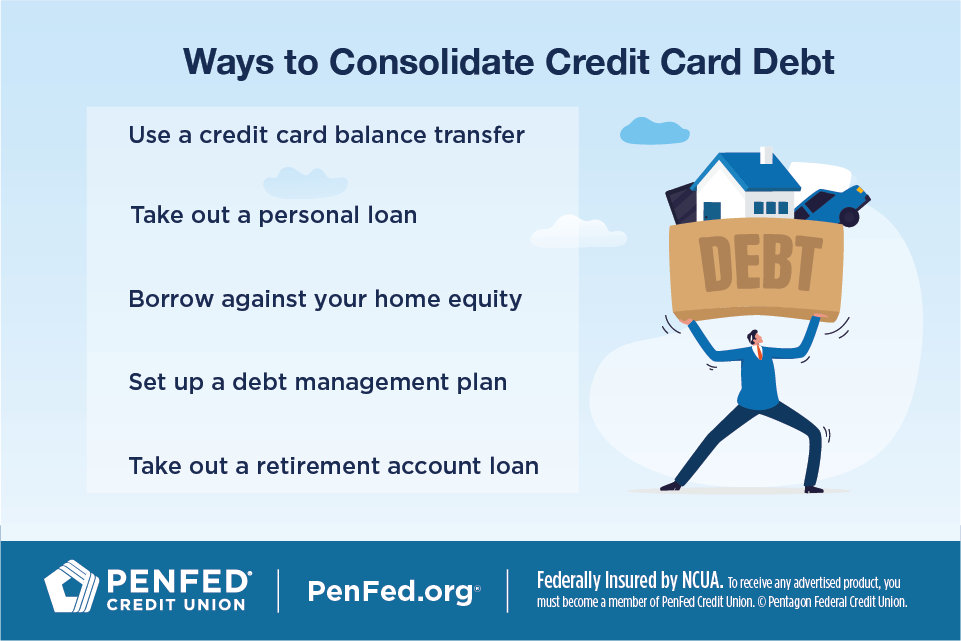

5 Ways to Consolidate Credit Card Debt

What You’ll Learn: How to consolidate credit card debt

EXPECTED READ TIME: 6 MINUTES

If you're burned out from juggling multiple credit card bills every month and you're looking for a way to pay off credit card debt, you might be relieved to know it's possible to combine debt from multiple credit cards into one monthly payment.

There are five common ways to consolidate credit card debt. While each method has its benefits, they can vary in cost and effectiveness depending on your personal situation.

1. Use a Credit Card Balance Transfer

One way to consolidate credit card debt is to move all your debt onto one credit card. This is known as a credit card balance transfer. If you already have a card with an excellent interest rate/APR, you could move all your debt to that card.

Some credit cards even have offers by which cardholders can transfer balances to that card to receive rewards points or a promotional interest rate on the transferred balance.

Often the best way to save money is to try to qualify for a new credit card with a 0% introductory rate. During your introductory period, which varies in length depending on the card, your debt will not accrue interest. This means every payment you make will go toward the principle of your debt, reducing the total amount you owe.

Keep in mind that introductory interest rates only so after possible last for a certain amount of time before a credit card's real interest rate kicks in. You'll need to pay down the transferred balance as much as possible, as soon as possible, to really reap the benefits of a balance transfer.

Additionally, many cards charge a one-time balance transfer fee of 3-5% of the total amount transferred (which would equate to $30 to $50 per $1,000 transferred).

Pros and Cons of Consolidating Credit Card Debt Via Balance Transfer

|

Pros |

Cons |

|---|---|

|

May offer 0% introductory APR |

Introductory APR is temporary and regular APR may be high |

|

Payments will go toward your debt principle |

Making only the minimum payment will not pay off your debt before the APR increases |

|

May offer rewards points |

Requires a 3-5% balance transfer fee |

Borrow Against Your Home Equity

One popular way to consolidate credit card debt is to borrow against the equity in your home. You can do this by taking out a home equity loan or by establishing a home equity line of credit, otherwise known as a HELOC. Borrowing against your home’s equity allows you to borrow money at a lower interest rate than with most other types of debt.

Borrowing against your home’s equity allows you to borrow money at a lower interest rate than with most other types of debt.

Home Equity Loan

A home equity loan allows you to use your home as collateral to borrow a lump sum of money. Because of this collateral, home equity loans usually offer lower interest rates than credit cards. Even better, the interest rate is fixed for the life of the loan.

Even though a home equity loan may enable you to consolidate your credit card debt, it is still a form of debt. You will still need to make regular payments, and your loan will still accrue interest. You may also be responsible for closing fees on a home equity loan.

Pros and Cons of Consolidating Credit Card Debt With a Home Equity Loan

|

Pros |

Cons |

|---|---|

|

Lower interest rates |

May require closing fees |

|

Fixed interest rate |

Your home serves as collateral |

HELOC

Another way you can use your home equity to consolidate your credit card debt is through a home equity line of credit, or a HELOC. Like a home equity loan, a HELOC uses your home as collateral to borrow money.

The difference is that with a HELOC instead of borrowing a set amount, you are establishing a line of credit. Your lender will set a credit limit and you can borrow up to that amount, as needed, during a set term (usually 10 years).

The interest rate on a HELOC is usually variable. Throughout the time you borrow from it, you will be required to make payments on the interest you accrue. Once your borrowing period ends, you will be required to make regular monthly payments on the principal and interest if you have a balance.

Pros and Cons of Consolidating Credit Card Debt With a HELOC

|

Pros |

Cons |

|---|---|

|

Establishes a new line of credit |

Variable interest rate |

|

Can borrow as needed within a period of time |

Must maintain interest payments throughout your period of borrowing |

|

|

Must repay principle and interest once period of borrowing ends |

3. Take Out a Personal Loan

A personal loan for debt consolidation is one way to tackle credit card debt more gradually. Personal loans are a type of installment loan, which means you borrow a specific amount of money and agree to pay it back with interest in a set number of payments (known as installments).

One advantage of personal loans is that unlike home equity loans, they don't require collateral. However, their interest rates are often higher than those of secured loans.

A personal loan for debt consolidation is one way to tackle credit card debt more gradually.

Personal loans usually have a fixed interest rate, so the amount you will pay per month will be the same throughout the life of the loan. However, some personal loans do come with variable rates that can change. Either way, the longer you take to repay your personal loan, the more total interest you will pay.

When evaluating borrowers, lenders consider factors such as the borrower's credit score, verifiable income, and debt-to-income ratio. If you don't have much credit history or you have poor credit, you still may qualify for a personal loan by using a cosigner.

Pros and Cons of Consolidating Credit Card Debt With a Personal Loan

|

Pros |

Cons |

|---|---|

|

Doesn't require collateral |

Interest rates are higher |

|

Fixed interest rate (usually) |

Must qualify |

4. Set Up a Debt Management Plan

By working with a debt management company or credit counseling agency, you can create a debt management plan. The goal of these plans is to help you pay off your credit card debt in three to five years.

The company or agency you work with will negotiate lower interest rates with your creditors, making it easier for you to pay on the principle of your debt. Then, instead of paying your creditors, you will make a single payment to your debt management company or credit counseling agency. Your agency will use that payment to pay your creditors.

The company or agency you work with will negotiate lower interest rates with your creditors, making it easier for you to pay on the principle.

You don't need great credit to qualify for a debt management plan, so it's a good option for borrowers with poor or little credit. However, participation in a debt management plan may temporarily impact your credit report. You may also have to pay setup or maintenance fees, and some agencies offer better terms than others.

Pros and Cons of Consolidating Credit Card Debt With a Debt Manager

|

Pros |

Cons |

|---|---|

|

Pay off debt sooner |

May temporarily impact your credit score |

|

Lower your interest rates |

May include set-up or maintenance fees |

|

Don't need great credit |

Some agencies offer better terms than others |

5. Take Out a Retirement Account Loan

Some employer-sponsored retirement accounts, like 401(k)s, allow you to borrow against them. These loans often have competitive interest rates that are lower than what banks or lenders offer. Retirement account loans also don't require a credit check and don't affect your credit score.

However, you won't earn interest on money you've taken out of your retirement account, which will slow your account's growth. And if you don't make timely payments, you may be taxed on the amount you have borrowed. Retirement account loans are also sometimes subject to penalties.

Pros and Cons of Using Retirement Funds to Consolidate Credit Card Debt

|

Pros |

Cons |

|---|---|

|

Competitive interest rates |

Miss out on earning interest |

|

Doesn't require a credit check |

Money may be taxed |

|

Doesn't affect your credit score |

May incur financial penalties |

The Takeaway

There are many ways to consolidate credit debt, but the best way for you will depend on your situation. Consider the total amount of credit card debt you carry, the interest rates on your credit cards, the types of collateral you have available, and your credit score. Then do your research to find the consolidation strategy that helps you reach your financial goals.

Explore Credit Cards Options Through PenFed

If you’re ready to use a single credit card for debt consolidation, discover the diverse products available to our members.