CHECKING / SAVINGS

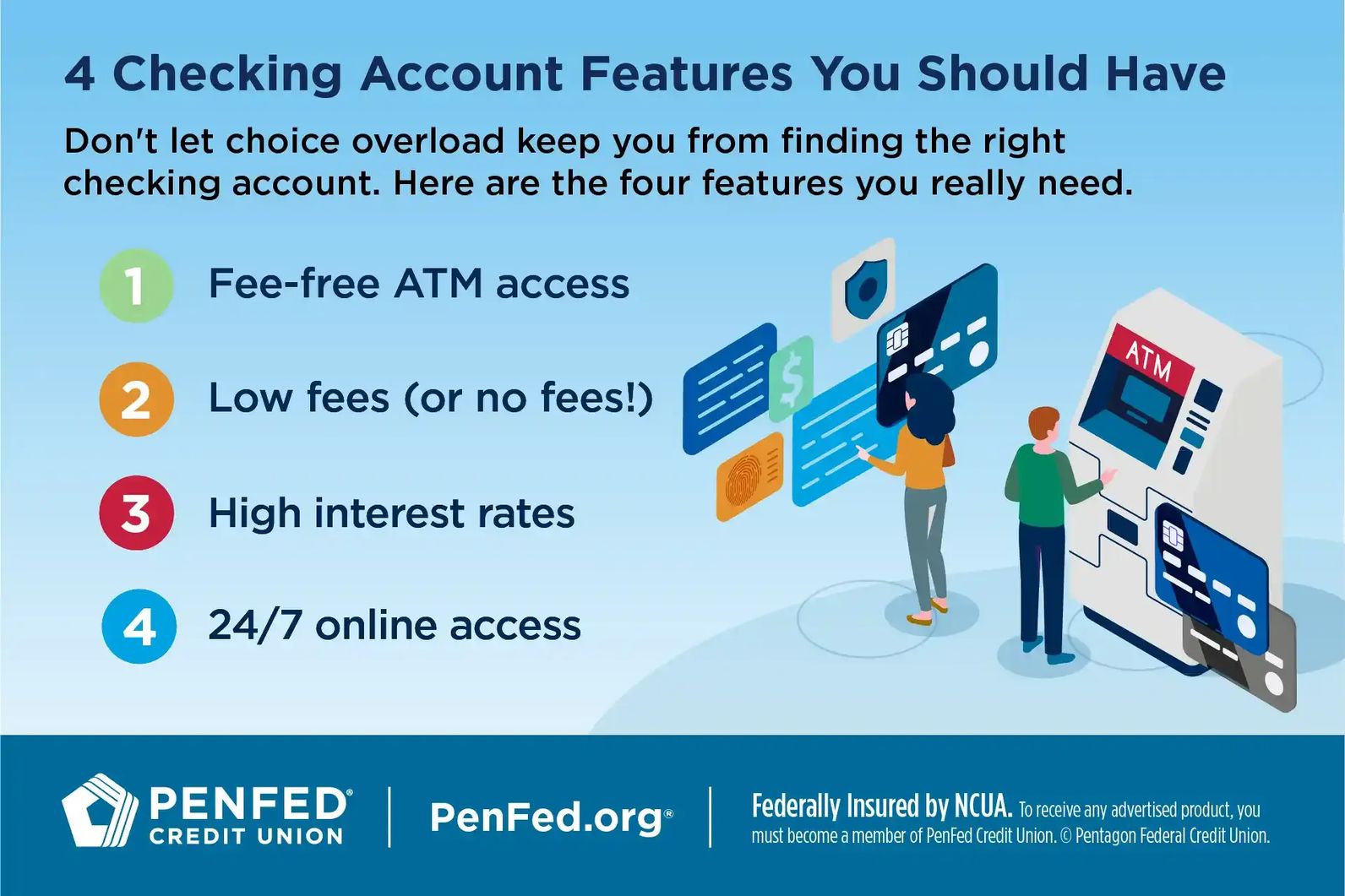

4 Features Your Checking Account Should Have

What you'll learn: What features your checking account should have

EXPECTED READ TIME: 6 MINUTES

A checking account is a must-have. But with so many types of checking accounts available, it can be hard to choose with confidence.

Let’s look at the most essential features your checking account should have.

What We'll Cover

1. Fee-Free ATMs

Many banks and credit unions charge fees whenever you withdraw money from an ATM. Fees can ran from as little as $2.50 to over $5.00 per transaction depending on whether the ATM you use is in- or out-of-network or international. If the ATM is out-of-network then you may be charged twice — once by your bank or credit union and once by the company that owns the ATM.

But checking accounts don’t have to work this way. Some financial institutions partner with major ATM networks to offer fee-free ATM access. For example, PenFed members can use over 85,000 ATMs nationwide without incurring fees. And many of these ATMs are located in well-known, conveniently located retailers.

2. Low Fees (Or No Fees!)

You have to have a checking account, but that doesn’t mean you have to pay for one.

Most banks and credit unions charge you monthly maintenance fees just for having an account. At an average cost of $10 to $12 per month, those fees add up! But with a free checking account, you can skip:

Monthly service fees

Regular transaction or service fees

Withdrawal or transfer fees

You’ll still get all the essential features you want with free checking like debit card usage, check writing, and access to a mobile banking app. You just won’t pay for it.

Free checking accounts don’t charge you regular monthly fees for basic checking account functions.

Will I Ever Have to Pay Fees With a Free Checking Account?

Free checking accounts don’t charge you regular monthly fees for basic checking account functions. However, there may still be charges for some features like stopping payments, ATM usage, or returned checks due to non-sufficient funds. In most cases, these fees are avoidable.

Searching for a free checking account full of exceptional features? You’ve found it with Free Checking from PenFed.

What does free checking actually mean?

3. High Interest Rates

Some financial institutions offer interest checking accounts that earn dividends on your balance. They usually earn less than traditional savings accounts, and some require you maintain a minimum balance to avoid higher monthly fees.

Interest checking accounts may earn as little as 0.05% to 0.5%. It’s common for rates to be tiered so that accounts with higher balances earn a higher APY. But even with a lower APY, an interest-bearing checking account can put extra money in your pocket.

Ready for an interest checking account that earns up to 8x the national average? Explore the benefits of Access America Checking from PenFed.

Some financial institutions offer interest checking accounts that earn dividends on your balance.

4. 24/7 Online Access

Your banking needs don’t always happen during banking hours. That’s why you need a checking account that offers 24/7 online access to your accounts.

Even if you’re not super techy, you can often save money and simplify your life by using online banking. For instance, many banks and credit unions will waive a statement fee if you choose to receive e-statements instead of paper statements.

With a robust mobile banking app, you can manage your accounts, deposit checks, and pay bills on the go. You can even setup balance alerts and transfer funds between accounts with a few taps.

Before opening a new checking account with a bank or credit union, check reviews of that institution’s website and mobile banking app.

But not all online banking tools are created equal. Before opening a new checking account with a bank or credit union, check reviews of that institution’s website and mobile banking app. Look for options that are secure, offer great features, and offer useful tutorials like PenFed’s guide to banking on PenFed.org and video overview of the PenFed mobile app.

Need better online banking options? PenFed offers them with either Free Checking or Access America Checking.

The Takeaway

Your checking account is the bank account you’ll use most often, so using it shouldn’t cost a fortune or be a hassle. And now that you know what to look for, choosing a great one won’t be a hassle either.

Bank with Confidence

Get access to a checking account built for the way you live.